S&P futures point to a slightly lower open ahead of today’s US non-mfg ISM and Service PMI data. European shares fall, while Asian shares are little changed. Several European countries, including Germany, are closed for Whit Monday leading to subdued trading. Crude futures have reversed overnight gains following the latest unexpected Gulf Crisis overnight, in which Gulf nations cut all diplomatic relations with Qatar amid striking allegations of funding terrorism, as latest unexpected Gulf Crisis overnight, .

Looking at other asset classes, the AUD/USD continues grinding higher after a stronger than expected Chinese services PMI and inventories data reduces chances of negative GDP print, iron ore futures +2.0%; GBP/USD fills gap to Friday close, after opening lower in Asia following Saturday’s attacks Bloomberg observes. European equity markets lower from the open, oil-related stocks underperform given heightened political uncertainty. Banco Popular in Spain trades -11% after reports of liquidity pressure due to deposit withdrawals. Core fixed income markets edge lower, German long-end steepens, some focus on wage pressures within PMI data. MXN leads EMFX higher as ruling party is projected to win state election.

European stocks are down, with the Stoxx Europe 600 lower by 0.2% with miners the biggest losers following a downgrade, while zinc and tin led base metals lower. Europe was dragged lower by the Basic Resources index which drops as much as 1.3% to one-month low, making biggest decline of 19 industry groups, after HSBC cuts valuations for London-traded mining companies, downgrades Antofagasta, Kaz Minerals. Antofagasta is biggest decliner in sector, falls 2.8%, Centamin -2%, ArcelorMittal -1.6%, Anglo American -1%. HSBC cuts LSE equities valuations by 4%-9% on assumption of stronger GBP/USD conversion rate, used to convert USD-denominated cash flows to GBP, bank’s analysts write in note Monday.

The big event of the session was the sharp shift in Gulf balance of power with geopolitics surging to the top of the agenda as investors digest the move by Saudi Arabia, Bahrain, the United Arab Emirates and Egypt to suspended air and sea travel to and from Qatar. Saudi Arabia cited Qatar’s support of “terrorist groups aiming to destabilize the region.” Which is ironic considering that a leaked memo by Hillary Clinton last year exposed both Saudi Arabia and Qatar as the two big state sponsors of regional terrorism.

Following the report, Qatar stocks have plunged over 7%, the biggest one day drop since December 2014 to the lowest since January 2016…

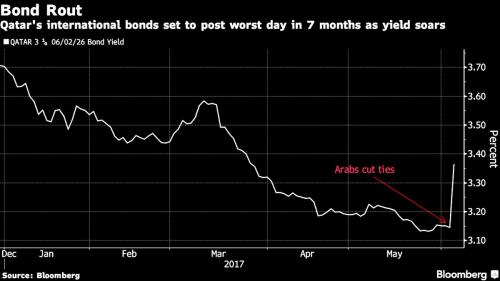

… while Qatar bond yield have surged in the worst day in 7 months…

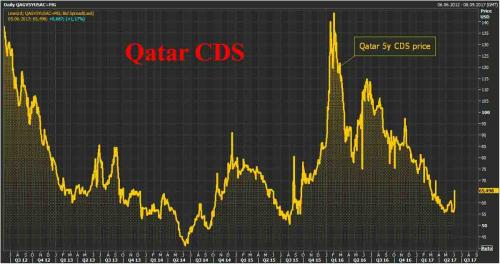

… and Qatar CDS spiked to 2 month highs.

Terror was also in focus in Europe following an attack at a popular London nightlife spot days before a national election.

Crude initially recovered some of Friday’s slump, although it has since filled the gap, while stocks in Qatar plunged as the market digested the fallout from the unexpected diplomatic twist.

Treasury yields remained near the lowest in seven months after U.S. jobs data missed forecasts last week. The peso rallied on signs the ruling PRI was ahead in the governor’s election for the key state of Mexico.

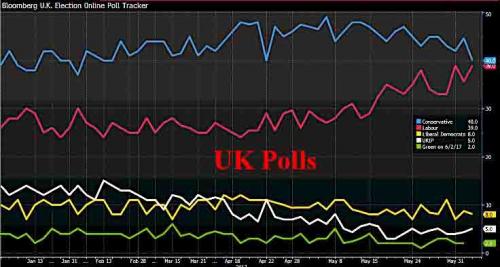

While the Fed has entered a blackout period ahead of next week’s rate decision, there is plenty of data in the coming days, with the headline being former FBI Director James Comey’s testimony before Congress following his dismissal by Donald Trump. U.K. voters go to the polls Thursday. Surveys of voters over the past few weeks have indicated a tightening race, increasing the chance that Prime Minister Theresa May might not get an increased majority.

Policy decisions from central banks in India and Australia are due during the week, as well as data on Chinese trade and inflation, U.S. factory orders, European industrial output figures and GDP reports for Australia, Japan and the euro area.

In Fx, the Bloomberg Dollar Spot Index dropped 0.2 percent, adding to a 0.4 percent decline on Friday. The yen fell 0.1 percent to 110.53 per dollar. Japan’s currency climbed 0.9 percent Friday after the U.S. data. The Mexican peso soared 1.6 percent, reversing an earlier drop. President Enrique Pena Nieto’s party is narrowly ahead in the election for governor of Mexico’s largest state in an official quick count, throwing it a lifeline ahead of next year’s general vote. Follow more on the vote here. The pound traded 0.1 percent weaker, paring its earlier loss. The euro also fell 0.1 percent to $1.1268.

In commodities, WTI crude was 0.5% lower to $47.46, after dropping 1.5 percent on Friday. Gold rose as much as 0.2 percent to $1,282.1 an ounce, hitting the highest since April. Tin fell 1 percent to $20,090 a ton and zinc traded 1.4 percent lower at $2,494.5 a ton on the London Metal Exchange.

In rates, the yield on 10-year Treasury notes rose one basis point to 2.17 percent after dropping five basis points on Friday. U.K. benchmark yields climbed two basis points.

Bulletin Headline Summary from RanSquawk

Market Snapshot

Leave A Comment