Retail is experiencing problems. Those problems relative to auto sales and restaurant activity which have been covered by the mainstream media. Make no mistake, these sections of retail are leading indicators of problems ahead. They need to be watched carefully and they could cause fear and risk off in stocks.

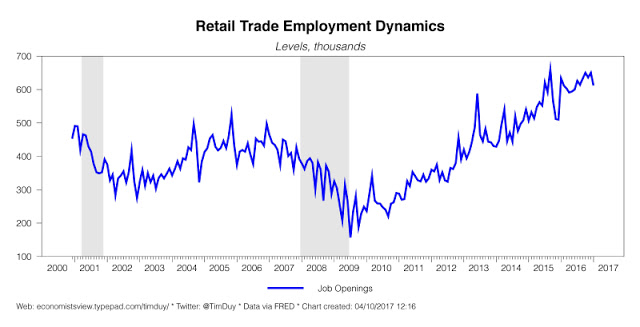

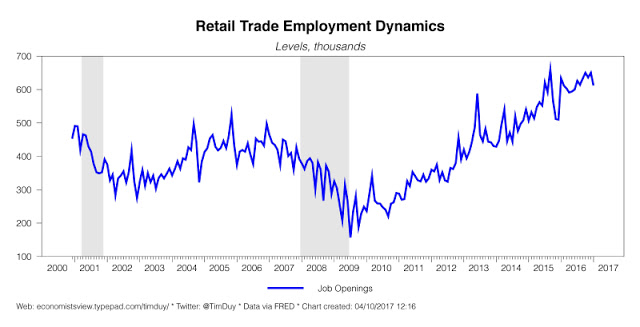

There are mixed signals regarding the state of retail, especially regarding job openings. According to economist Tim Duy, job openings seem to be strong:

By Permission

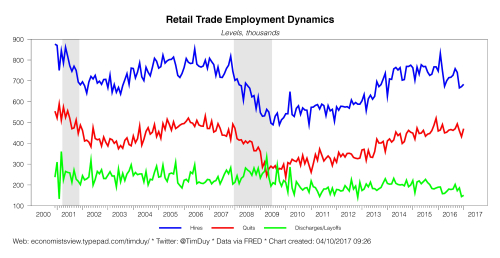

But there is a definite slowdown in hiring and this is showing a bad trend in retail:

By Permission

So, layoffs have not started. But that doesn’t mean that retail is not slowing. It is. And for the auto industry, the sales force is making fewer commissions. That is like a partial layoff. Waiters and waitresses make money through tips. If there are fewer customers and fewer tips, those act as a partial and hidden layoff as well.

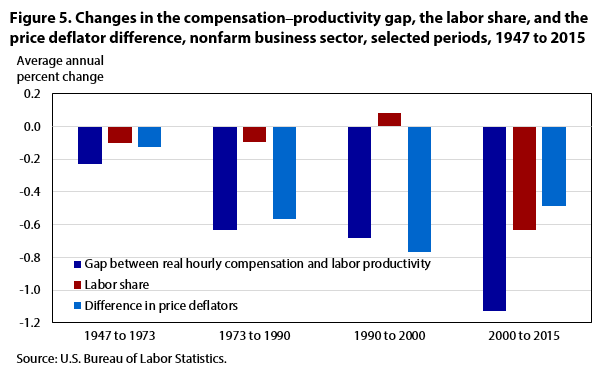

We can see the trend happening over years, that labor is being crushed by the capitalists, eventually resulting in distress to capitalism itself:

The Fed is talking about reducing its balance sheet, which is could cause a contraction of the money supply, and raise interest rates, which could invert the yield curve. There is really not enough money on the main street, but too much money in certain markets. It is a risky thing for the Fed to take down the bubbles in stocks, etc, when the consumer is so constrained. On many levels, the Fed is too tight already.

Edward Lambert has said that he expects a recession in 2017. We are teetering on the brink of recession based on these leading economic indicators. We aren’t there yet, but Lambert said this in February:

From what I see, inequality will grow… and importantly, negative externalities will grow and accumulate. Businesses will make more profit in the short-term, but in the medium-term, the negative externalities will burden the economy.

Leave A Comment