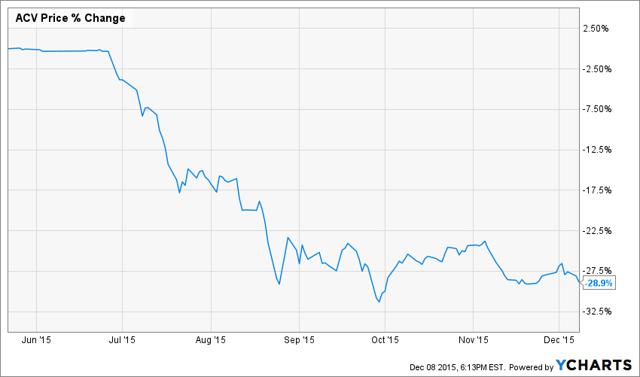

Need a convenient way to fulfill a vow of poverty? Invest in closed-end fund IPOs. Here is the most recent one that I have seen, the AllianzGI Diversified Income & Convertible Fund (ACV).

As described in Is The Market Fair? Yes Vs. No, closed-end fund IPOs have a consistently losing record. It fits the pattern of the earlier examples that I have discussed in past articles. The underwriters propped up the price long enough to saddle up and ride out of town before the market re-priced this down by over 25%. The bag holders may have overshot somewhat. Today, the market price is a 16% discount to NAV, which is greater than the average discount year to date.

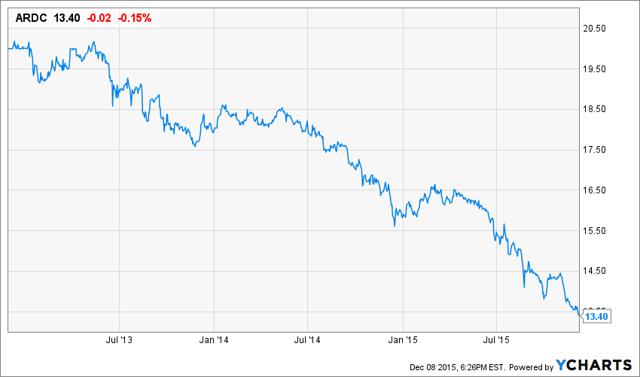

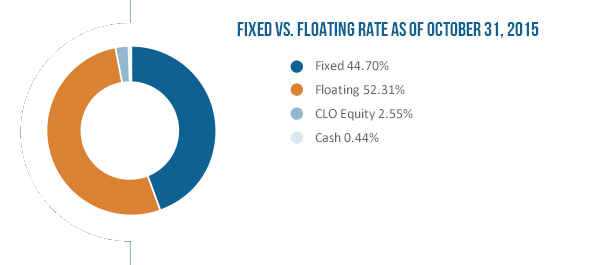

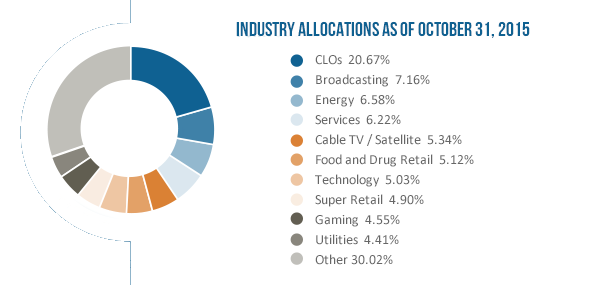

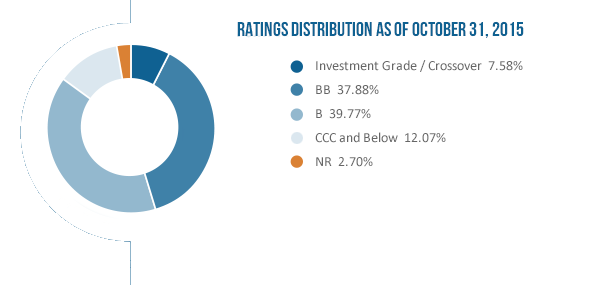

Another discounted closed-end fund to consider is Ares Dynamic Credit Allocation Fund (NYSE:ARDC). It has a 17% discount which is greater than its 14% YTD average discount. It has a 10% distribution yield, 6% of which is from income only.

Top 10 Issuer Holdings

Issue

%

Rite Aid Corp

1.93%

Alinta Energy Ltd

1.63%

Gala Coral Group Ltd

1.55%

TMF Group

1.47%

Altice International

1.41%

Travelport

1.40%

NBTY, Inc.

1.37%

Ferrellgas Partners

1.29%

Guala Closures S.P.A.

1.26%

Premier Foods

1.14%

Total

14.45%

This data is subject to change on a daily basis.

These assets are out of favor and so are available for sale at a substantial discount to their value. For a hedge, one can short similar assets at a premium via Eagle Point Credit (NYSE:ECC ).

The NAV is $15.49 and it is hard to think of a reason why the stock should trade for a premium to that. There is no evidence of management skill that would justify such a premium.

Leave A Comment