In a “Trading Floor” interview, Saxo Bank CIO and chief economist Steen Jakobsen, discusses the role of central banks in the global economy with Saxo Bank’s Michael McKenna.

“Central banks can do nothing,” says Jakobsen.

He calls the current central bank low to negative interest rate policies the “New Nothingness”.

What follows is a guest post interview, courtesy of Steen Jakobsen, Michael McKenna, and the Saxo Bank “Trading Floor”.

Original Link : Central Banks Can Do Nothing

In guest post format, I have no block quotes or indents. I offer my comments at the end.

Central Banks Can Do Nothing by Steen Jakobsen

By Michael McKenna

In April 2015, Saxo Bank chief economist Steen Jakobsen said that zero rates, zero growth, zero productivity, and zero reforms have left a great many countries adrift in a “new nothingness”.

The products of this nothingness, said Jakobsen, include apathy, stagnation and “an economic outlook based more in peoples’ heads than in reality”. On the cultural level, he continued, the widespread lack of dynamism and new ideas has empowered a political class that is “mainly interested in maintaining the status quo”, even as that status quo provides sharply diminishing returns.

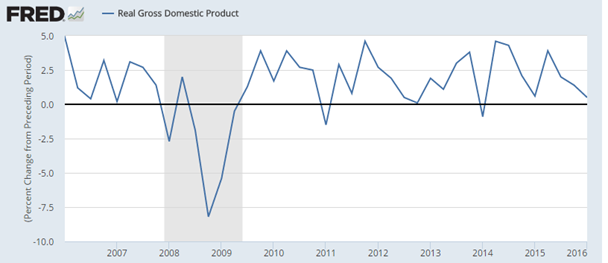

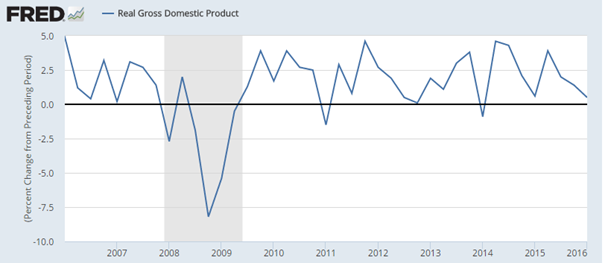

US GDP growth, for instance, is hugging the zero line:

Source: Federal Reserve Economic Data

A little more than one year on and we remain, in terms of economics and monetary policy at least, profoundly entranced by this combination of zero-bound policies and continual “emergency measures”.

Culturally and politically, however, the past 12 months have demonstrated time and time again that nature abhors a vacuum.

In Europe, for instance, we have the spectacle of the European Union’s second-largest economy voting on whether it wants to leave the union next month. In the United States, the candidacies of Democratic senator Bernie Sanders and Republican front-runner Donald Trump have benefited enormously from widespread frustration with the current consensus, particularly in the realm of trade where both candidates – one hard left, one populist right – point to a declining US manufacturing sector and a recovery bereft of “breadwinner” jobs as signs that the country has been led astray.

The list doesn’t end there. From the European migrant crisis to the rise of far-right political parties such as Germany’s Alternative für Deutschland and France’s Front National; from the the apparent stalling of the Federal Reserve’s policy normalisation plans to the European Central Bank’s continued adventures in quasi-permanent stimulus, the past 12 months have demonstrated that “nothingness” breeds restlessness.

This restlessness, as we have seen, will find release on the cultural level despite the hesitancy of central bank policy mandarins and political elites.

With this in mind, we sat down with Jakobsen to discuss the new nothingness, the even newer reactions to such, and his outlook for the global economy

TradingFloor.com: The “new nothingness” thesis was based on zero rates, zero growth, zero reforms. But you hinted that all of this nothingness has spilled over into culture and politics as well… do these macro facts hinder peoples’ imagination, or their ability to deal with the problem?

Steen Jakobsen: Yes, I think so. This year, we see a growing gap between the central banks’ narrative – which is that you have a trickle-down impact from lower rates – and [the situation on the ground].

People understand that zero interest rates are a reflection of zero growth, zero inflation, zero hope for changes, and zero reforms.

In my opinion as an economist and a market observer, people are smarter than central banks. And because they are smarter, they can live with policy mistakes for a while because the narrative is very strong and because people like (European Central Bank head Mario) Draghi and (Federal Reserve chief Janet) Yellen have these platforms from which they not only talk but occasionally shout, and they are deemed to be “credible”, scare quotes mine…

We see [this gap] in the Brexit debate as well, where the elite and the academics talk down to the average voter. By doing that, of course, they alienate the voters from their representatives.

Counterpoint?: “Too many politicians are listening to their [voters]” says European Commission president Jean-Claude Juncker.

That’s what we see globally, that’s why Brazil is going to change presidents, why Ireland could not get its government re-elected with 6% growth. It’s not about the top line, but about the average person seeing that we need real, fundamental change.

TF: Earlier this year, you said that the social contract – the agreement between rulers and the ruled – is broken. It made me think of this year’s Davos meeting, which showed a leadership class terrified of slowing jobs growth and enamoured with the idea that population movements might be used to address this. Given the current unpopularity of globalisation and its effects, would you say that there are some things it is impossible for 21st century leaders and the led to agree upon? Is a social contract impossible?

Leave A Comment