Is gold dead?

Over the last three years, the SPDR Gold Shares ETF (GLD) has lollygagged in a sideways direction.

I’d honestly rather watch paint dry than analyze a gold chart.

Given such an uninspired performance, I don’t believe that gold warrants a major weighting in your portfolio.

Of course, my assertion above constitutes sacrilege to any “gold bug.”

So let me explain…

Please don’t confuse a gold ETF with owning physical gold.

A gold ETF is a piece of paper that represents a loose claim (at best) on gold.

Vaulted gold, however, is real — and can be called upon in any crisis event.

Still, some folks will insist on owning proxies for gold, rather than actual gold bullion.

If you’re among those who favor paper gold, don’t simply buy an ETF.

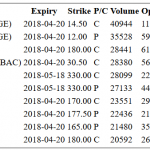

Below are three more intelligent routes into gold.

An Alternative to Owning Gold

While the Fed prints money like confetti, it’s important to gain some exposure to gold.

As Louis mentions above, ETFs are not a suitable way to do so.

Gold ETFs suffer from a tracking error against physical gold’s price. And that error can increase if the gold price zig-zags violently.

But even physical gold has its drawbacks.

Physical gold yields nothing. It incurs storage costs. And it’s difficult to sell for full value when you need cash or your gold view has changed.

So what’s the best route into gold investing?

Buying shares of carefully selected gold mining companies.

Gold mines offer the following advantages over owning gold or gold ETFs.

Of course, there are some pitfalls to watch out for that can offset these advantages…

For instance, some mines have very high mining costs. Or they can be located in politically risky areas. Or the mines can be close to depleted.

Leave A Comment