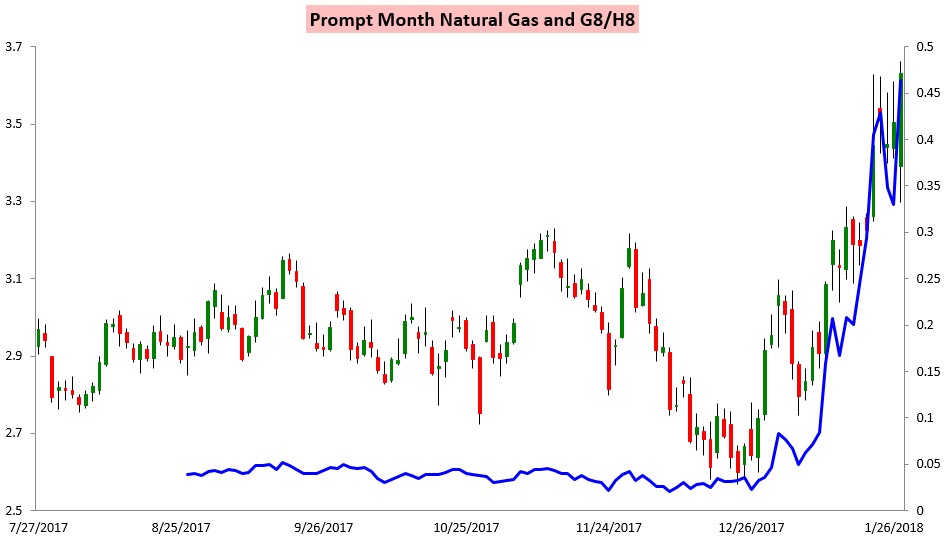

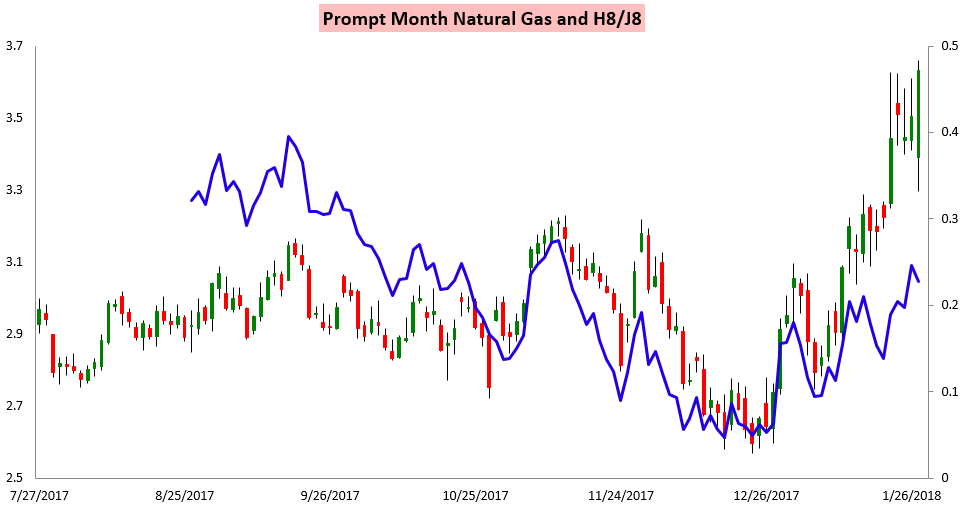

The February natural gas contract expiry today was one of the most anticipated in awhile, and it did not disappoint. After a rather significant gap down last evening on medium-range heating demand losses, prices rallied through the day and spiked into expiry, expiring 3.6% above the Friday options expiry settle.

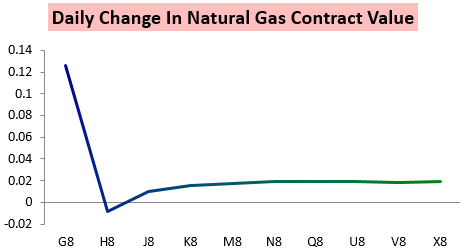

Despite all this excitement into expiry for the February natural gas contract, the March contract was actually then the weakest, setting down slightly on the day.

The result was a record G/H expiry, with the final leg today being driven by overnight and afternoon colder trends on some key weather models.

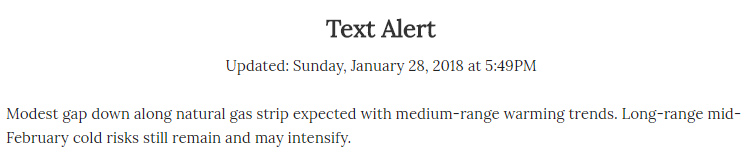

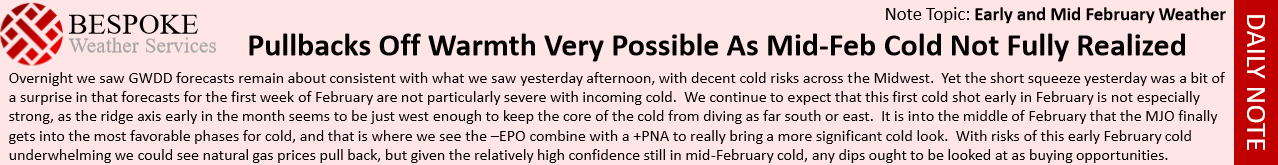

This gap close did not come as a surprise to subscribers. Last evening we sent out Trader level subscribers a Text Message Alert warning that a gap down was likely but that mid-February cold trends could intensify on model guidance, which would help stabilize prices.

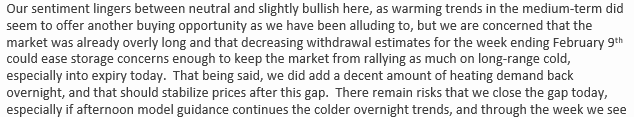

Our Morning Update then highlighted the risks that we would close the gap today, with afternoon guidance continuing those overnight trends.

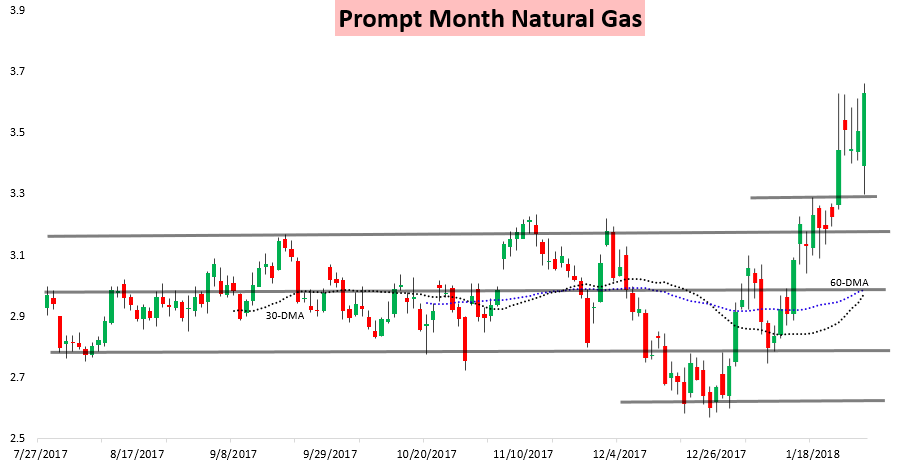

This all fits with the narrative that was included in our Note of the Day last Wednesday, January 24th, where we were concerned early February could trend a bit warmer but then models could pick up on the mid-February cold risks they saw today.

The question now is how sizable those cold risks are and whether they will be enough to really cause storage concerns. Despite the gap down today and rally in the February contract, the H/J spread actually ticked down today.

There are a number of risks for the March contract in both directions as it takes over as the prompt month contract tomorrow. Our Afternoon Update for clients attempted to break it down, analyzing the latest model guidance and price action to determine which way risks were skewed through both the rest of the week and the month of February. We also included our updated GWDD forecasts and model trend expectations.

Leave A Comment