By way of a video from Boom Bust (the best show for economics news), Barclays says that the 60 basis point drop in corporate profit margins in the S&P500 over the last 12 months is a sign that we are heading toward a recession. (see 22:30 minute point of video.)

Video Length: 00:27:50

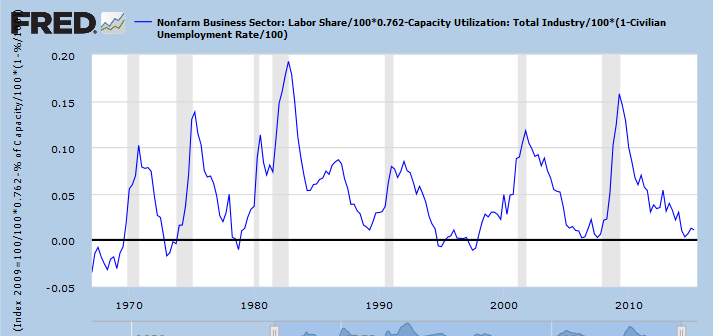

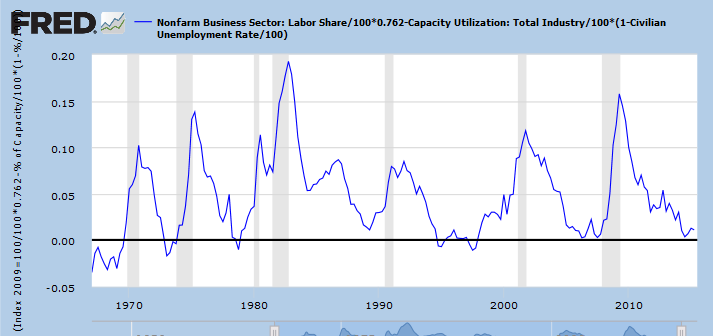

The Barclays’ message coincides exactly with the principle of Effective Demand that profit margins maximize when real GDP hits the effective demand limit. Real GDP hit the effective demand limit in 3rd quarter 2014 as seen in the following graph when the plot almost hit zero on the y-axis. That was 12 months ago.

If the economy does head toward a recession now, the economy will have acted precisely according to the principle of profits maximizing at the Effective Demand limit.

So far the pieces of the puzzle for the business cycle’s end are falling into place nicely. But more time is needed to be sure that the code of effective demand has been broken. How will the economy behave now as it heads toward a recession?

Note: In the video, they compare now to 1985 when profit margins also fell 60 basis points but there was no recession. In the graph above, you can see that the economy was not near the effective demand limit (zero on the y-axis) in 1985. So I would tend to say that a recession will occur this time because the economy hit the effective demand limit already. Time will tell…

Leave A Comment