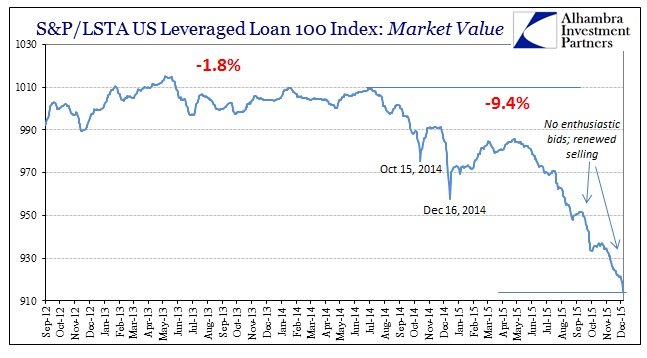

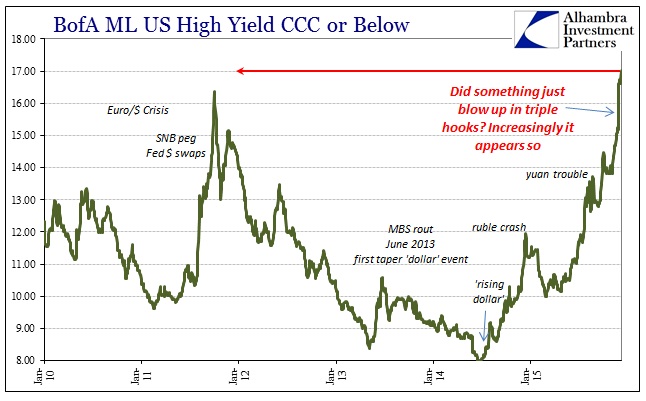

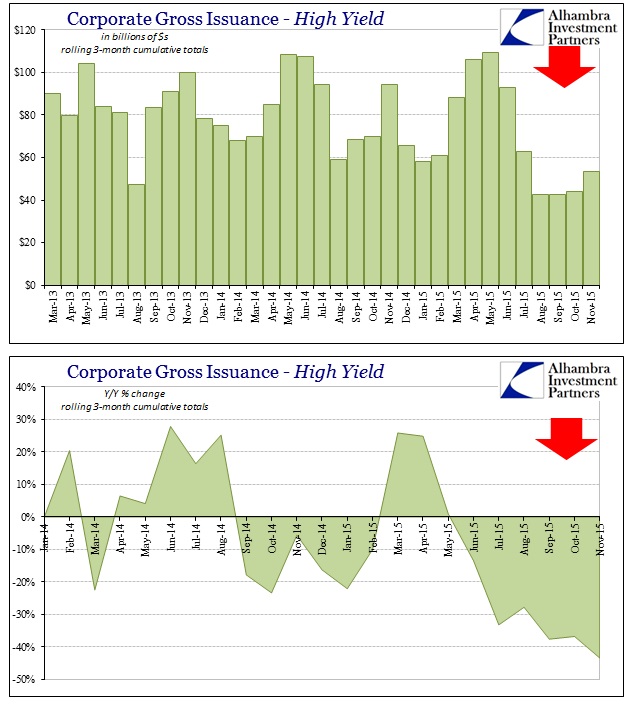

If there is a shift in the credit scheme of the junk bond bubble of late, the reduced volume in issuance would suggest why. While issuance, including high yield and leveraged loans, has been volatile the past few years it had never been so persistently beaten down as it is now. In other words, there had been “slow” periods in the past, short-term rough patches to be waited out (by both investors and obligors), but this one is much longer and deeper than those and significantly so. That might explain the apparent rush toward balance sheet recognition this week, as the haywire junk bond market (secondary) signals increasingly that issuance has undergone true paradigm inflection (and therefore might not come back this time).

In terms of strictly high yield gross issuance, November, according to SIFMA, saw $22.9 billion which was 18% less than November 2014. For the past three months cumulative, the contraction in issuance has reached -43%. Large scale rejection of this kind is becoming more the baseline than short-term consideration, especially as, again, prices spiral further toward a crash.

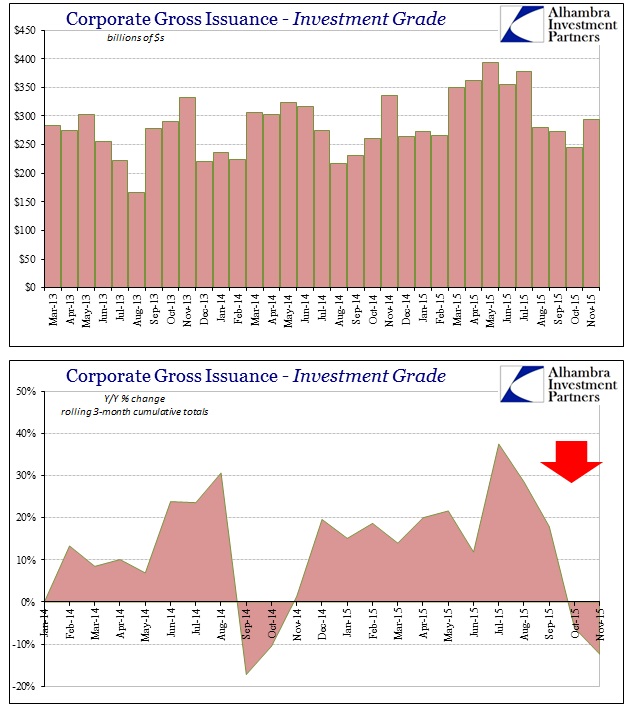

In addition, however, it seems as if investment grade issuance may have joined the misdirection. Total floated IG securities in November were just $97.9 billion, or more than 19% below the $121.3 billion from November 2014. The past three months cumulative has seen only $294.6 billion (“only”) compared to $336.1 billion in the same three months of 2014. Year-to-date, IG issuance is up almost 11% from last year, but that only highlights the sudden difficulties of late – especially since bond issuance for highly-rated corporates was almost insane this summer. That, too, might mark an inflection, as even upper tier issuers participate in cycle-end blowoffs.

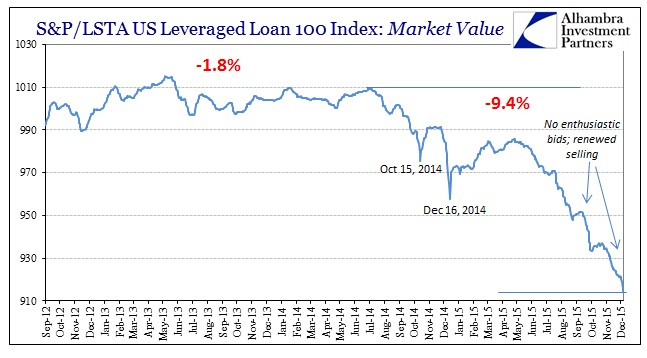

It is too early to tell if the primary market climate for IG has durably shifted as it increasingly appears likely of HY and junk (including leveraged loan issuance, down 18% in the rolling three-month total ended in November ), but there is good reason to believe it has. Pricing behavior, especially the steady and unrelenting declines in prices (surge in yields), more than suggests a systemic reset (quite serious, at that) in risk expectations and calculations. And unlike those that would accompany a monetary policy shift toward economic “overheating”, this bond market readjustment presupposes the opposite side of the risk spectrum; i.e., credit risk not interest rate risk.

Leave A Comment