Over one year ago, when the “conventional wisdom” punditry was dreaming up scenarios in which the Fed could somehow hike rates to 3% and in some magical world where cause and effect are flipped, push the economy to grow at a comparable rate we said that not only is the Fed’s tightening plan going to be aborted as it represents “policy error” and tightening in the middle of a global recession, but it will result in the Fed ultimately cutting rates back to zero and then, to negative.

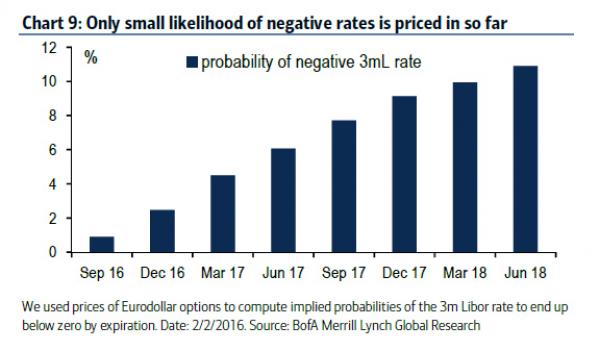

Gradually the market is agreeing with us, and as the following chart shows, the probability of a negative 3 month Libor rate in 2 years has risen to 10%.

It is also why, as we showed earlier, the bets on NIRP within two years have spiked in recent months, in what is the “shadow market crash” trade du jour.

* * *

So now that talking about NIRP in the US is no longer anathema but a matter of survival for market participants for whom frontrunning the Fed’s policy failure has emerged as a prerequisite trade, the question is: what are the mechanics of NIRP, what are the implications of negative rates for US markets.

Here is the handy answer courtesy of Bank of America’s Marc Cabana

Mechanics of negative rates

Negative interest rates have generally been employed after a central bank has already lowered their deposit rate to zero and they either desire to (1) further ease monetary policy to fight the growing threat of deflation, i.e. ECB, BoJ, Riksbank policies, and / or (2) reduce capital inflows that were resulting in undesired currency strength, i.e. SNB and DNB policies.

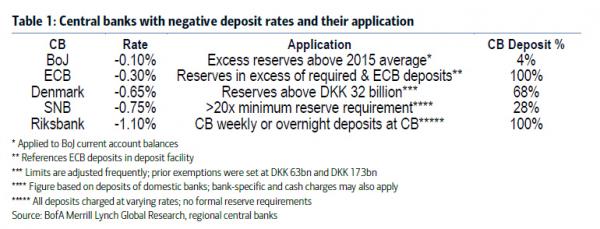

To implement negative rates, central banks set their “deposit rate” or rate at which banks can deposit funds with monetary authority at a negative level. This results in banks paying a fee for holding their reserves with the central bank. Most countries that have adopted negative rates do not apply them to required reserves but only apply them to all or some of the deposits at the central bank, Table 1.

So why don’t banks holding excess reserves just move them off of their balance sheet via lending or asset purchases to avoid the fee? Recall, monetary policy generally runs through a closed system and the central bank is the only entity that can permanently change the amount of reserves outstanding. Funds loaned by one bank or used to purchase securities will eventually end up re-deposited at another, which means that reserves can only be re-allocated within the system but not independently withdrawn from it. Banks could convert their excess reserves to cash but storage costs generally make this unattractive unless rates are deeply negative.

Taking rates negative in the US

To implement negative interest rates in the US, the Fed could utilize the overnight reverse repo facility (ON RRP) and interest rate on reserves. These tools could potentially shift the fed funds effective into negative territory, though the amount of negative fed funds trading would likely depend on the cost of holding reserves.

ON RRP: If the Fed desired to take rates negative they could set the ON RRP rate below zero or temporarily suspend the facility. Setting the ON RRP rate below zero would lower the “soft floor” it establishes on interest rates and likely shift lower levels on other money market instruments. It is also possible that the Fed could temporarily suspend the ON RRP facility, which would move money market rates lower as money funds and GSEs would no longer have a backstop investment option at the Fed. We guess that the Fed would maintain the ON RRP facility in a negative rate environment since they would likely view any period of negative rates as temporary and set the ON RRP rate at 20 to 25 basis points below IOER. Note that the Fed did not see the existence of the ON RRP and the temporary reserve draining that it provides as contradicting prior periods of expansionary monetary policy accommodation, Chart 2 (the ON RRP was used for “testing” purposes at that time).

Leave A Comment