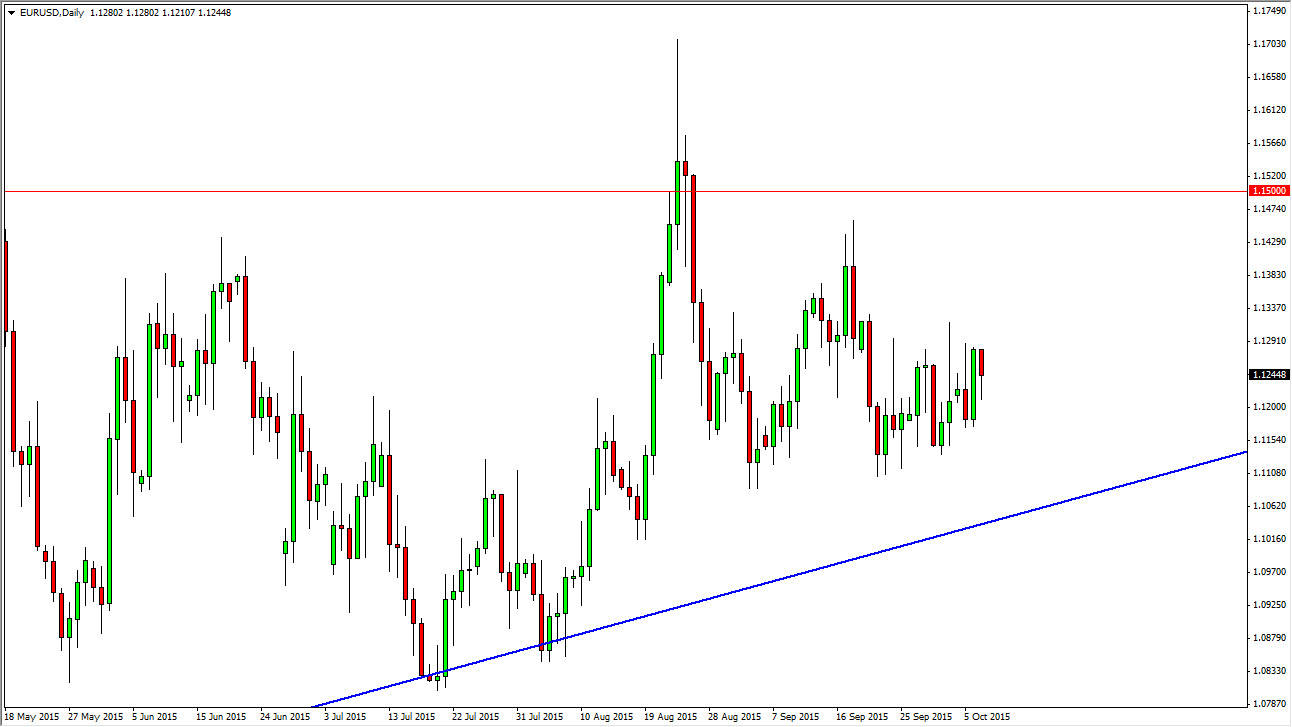

The EUR/USD pair fell during the day on Wednesday, as we continue to bounce between the 1.11 level on the bottom, and the 1.13 level on the top. Today could give us a little bit of momentum in one direction or the other though, because we have the FOMC Meeting Minutes coming out, which could give us a bit of insight as to what the Federal Reserve is thinking. The fact that they did not raise interest rates at the last meeting of course was a bit of a shock for some traders, but they also suggested that it was perhaps due to concerns about global markets and that kind of situation.

However, if it comes out that perhaps it’s a little bit more fear directed at the United States, this pair could finally break out to the upside. When you look at the longer-term charts, it’s hard not to notice that we are forming a pretty significant ascending triangle, with the top being at the 1.15 level.

The significance of 1.15

Quite frankly, if I wasn’t asked to cover this specific pair, I wouldn’t be bothered with even paying attention to it at the moment. However, a lot of short-term traders like this pair due to the tight spread. Ultimately though, I believe that the real battle will be whether or not we can get to the 1.15 handle. Once we break above there significantly and permanently, that is a trend change for my money.

In the meantime, I think we will continue to bang around in this 200 pips range, although I could perhaps make an argument for buying this market above the 1.1325 handle. At least at that point in time it would become somewhat clear that we were going to reach for the 1.15 handle. In the meantime though, the one thing that I do respect is the uptrend line below, and as a result I think that the downside is going to be somewhat limited. You can go ahead and trade this pair, but you have to be willing to do it off of something like the 15 minute chart.

Click on picture to enlarge

Leave A Comment