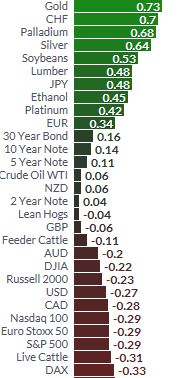

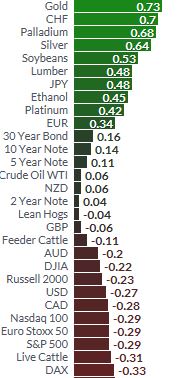

Relative Performance (1 Day) – Finviz.com

Safe haven gold continued to eke out further gains of 0.73% today and reached its highest level in 11 months at $1,338.65/0z. The latest gains came after North Korea’s latest and most powerful nuclear test again saw investors diversify into safe haven gold and other safe haven assets.

Asian and European shares have fallen and the geo-political risk led to the the usual knee-jerk shift to safe havens pushing the yen, Swiss franc, gold and silver higher.

The Nikkei was down 0.93 and EuroStoxx 50 was down 0.45%. The Stoxx Europe 600 Index declined, with all industry sectors in the red.

The U.K.’s FTSE 100 Index dipped 0.3 percent and Germany’s DAX Index fell 0.5 percent. The MSCI All-Country World Index sank 0.2 percent, the largest dip in more than two weeks. Stock market futures suggest a difficult day for global equities.

The White House warned any nation doing business with Kim Jong Un’s regime would be met with economic sanctions and trade embargoes, and Trump’s defense chief said the U.S. has “many military options.”

Gold’s gains came after gold rose both last week and in August when gold and silver saw strong safe haven gains of 4% and 5% respectively.

Leave A Comment