USD/JPY

The US dollar had a volatile session on Friday as the jobs number came out less than anticipated. Because of this, the markets sold off rather drastically, but found enough support to turn around and bounce above the 110 level again. By doing so, this shows the resiliency of this market but I also see a significant amount of resistance at the 111 level. Once we break above there, I feel that the market will probably go looking towards the top of the consolidated range, meaning that we should go to the 114.50 level.

This market has been consolidating for some time, and quite frankly nothing that I’ve seen recently tells me that it’s going to change. If we did breakdown below the 108.50 level, at that point I think the market could sell off to the 105 handle. However, it does not look likely to do so currently.

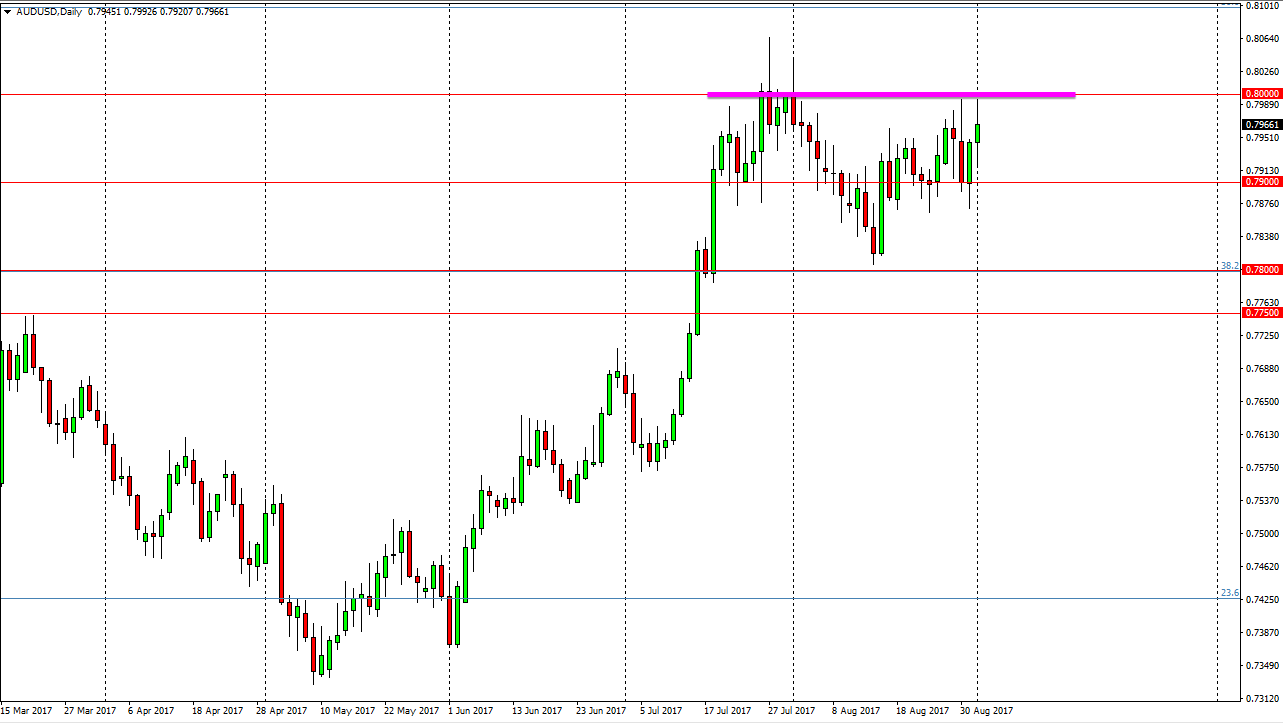

AUD/USD

The Australian dollar was very choppy during the session as well, but gold markets continue to look very healthy. Because of this I think that the market will eventually get very bullish of the Australian dollar, and on a daily close above the 0.80 level, I think that it’s time to start buying. Until then, short-term pullbacks could be buying opportunities, but you should be very careful and keep your stop losses tight until we clear that area if you feel the need to go long.

I believe that the 0.7750 level underneath should be supportive, and because of this I think that dips continue to offer buying opportunities. That’s not to say that we can break down, it’s just that we have seen such a significant amount of resiliency to the Australian dollar, and more importantly the gold market, that it makes sense the buyers should continue to be aggressive.

Leave A Comment