Plenty of earnings reports are still to come, but the Q4 reporting cycle is past its peak, with results from 62% of the S&P 500 members already out. With 68 index members reporting results this week, the earnings season will be over for 76% of S&P 500 members by the end of this week.

The picture emerging from this earnings season is one of all around weakness, with growth hard to come by in the face of a slowing global economy, the strong U.S. dollar, and weakness in the oil and other commodity sectors. This isn’t a new problem, we have been discussing these headwinds the last few reporting cycles as well. In other words, the earnings recession continues with Q4 earnings for the S&P 500 index on track to be below the year-earlier level – the third quarter in a row of negative earnings growth for the index.

Recent weakness in oil and other commodity prices has effectively guaranteed that this negative growth trend will continue into the current and following periods as well. In fact, all of the earnings growth for the S&P 500 index in 2016 is now entirely expected to come in the back half of the year, with growth in the first half of the year now expected to be in the negative. Earnings growth in the current period is now expected to be in the negative while 2016 Q2 is flat from the year-earlier level.

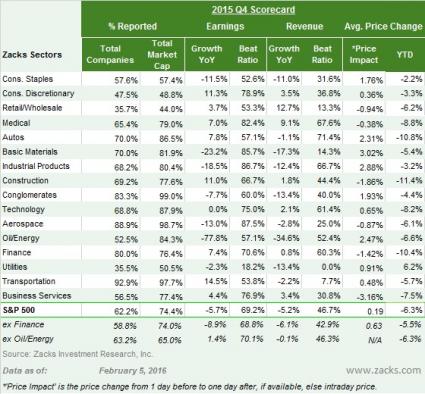

Q4 Scorecard (as of Friday, February 5th)

Total earnings for the 314 S&P 500 members that have reported results already are down -5.7% on -5.2% lower revenues, with 69.2% beating EPS estimates and 46.7% coming ahead of top-line expectations. With these 314 index members accounting for 74.4% of the index’s total market capitalization, we have effectively crossed the halfway mark in the Q4 reporting cycle.

The table below provides the current Q4 scorecard

The aggregate growth picture is actually even weaker once adjusted for the +7.4% growth in the Finance sector, which itself is benefiting from easy comparisons at Citigroup (C – Analyst Report). Excluding the Finance sector, total earnings for the rest of the index members that have reported results would be down -8.9% on -6.1% lower revenues.

The charts below provide a comparison of the results thus far with what we have seen from this same group of 314 S&P 500 members in other recent periods.

Leave A Comment