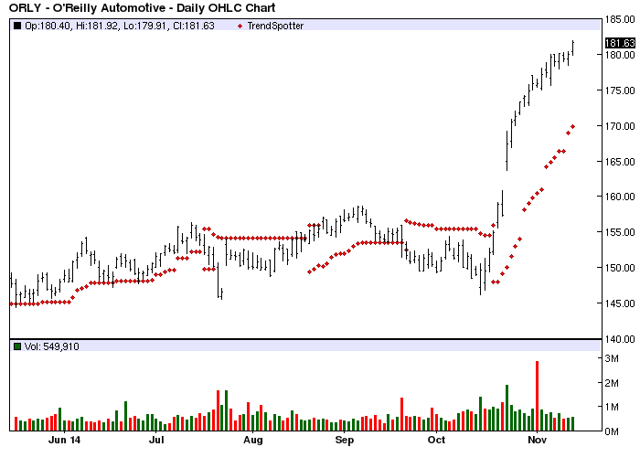

The Chart of the Day belongs to O’Reilly Automotive (NASDAQ:ORLY). I found the stock by sorting the All Time High list for the most frequent new highs in the last month then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 10/20 the stock gained 17.21%.

O’Reilly Automotive, Inc. is a specialty retailer and supplier of automotive aftermarket parts, tools, supplies, equipment and accessories to both “do-it-yourself“ customers and professional mechanics or service technicians. O’Reilly stores carry an extensive product line consisting of new and remanufactured automotive hard parts, such as alternators, starters, fuel pumps, water pumps, and brake shoes and pads, maintenance items, such as oil, antifreeze, fluids, engine additives and appearance products, accessories, such as floor mats and seat covers.

Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment