Earnings season is just beginning and so far, the tone is bullish. “We are expecting another solid earnings season for S&P 500 companies with quarterly EPS reaching a record ~$33.75 in 3Q17 — a positive earnings surprise of ~4.5%,” writes Dubravko Lakos-Bujas, JPMorgan’s head of US equity strategy. Meanwhile CNBC calculates that the third quarter tends to post the best-gain of all four seasons.

With this in mind, we used TipRanks’ Earnings Calendar to see which hot stocks are due to report their earnings in the next five days. Crucially, the Earnings Calendar also displays the analyst consensus and average price target of each stock, so you can immediately assess the Street’s outlook on the stock going into the print.

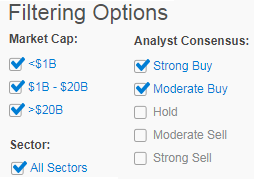

Here we searched for only stocks that have a ‘Strong Buy’ or ‘Moderate Buy’ analyst consensus rating- and also scanned for stock’s with notable upside potential from the current share price:

Now let’s delve deeper into these three top stocks:

1. Netflix (NASDAQ:NFLX)

Keep your eyes peeled for the Q3 earnings report from entertainment powerhouse Netflix, scheduled for Monday after market close. Analysts are growing increasingly optimistic on the stock’s outlook. Netflix boasts the ability to boost prices without losing customers- a very encouraging sign for future growth potential.

Goldman Sachs analyst Heath Terry is certainly feeling the heat. He has just boosted his NFLX target from $200 all the way to $235. Even factoring in NFLX’s current record-high share price of almost $200, Terry’s new price target still projects big upside potential of close to 18%. Terry explains why he is even more bullish than consensus:

“While high expectations, particularly in light of the price increase, could lead to volatility post results, we believe upward revisions to consensus estimates will ultimately drive further outperformance… Content remains the primary driver of subscriber growth and engagement (and the pricing power that comes with it).”

Leave A Comment