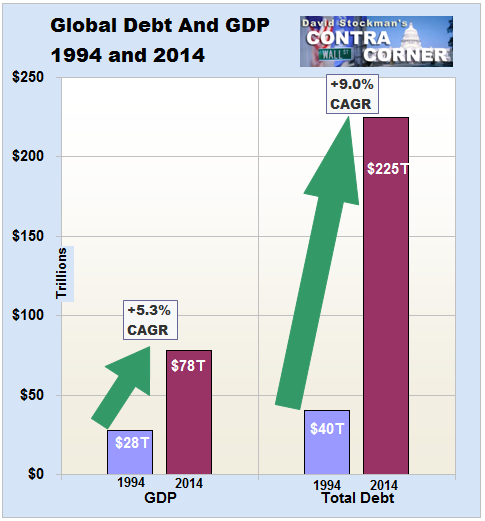

$225 TRILLION!

Global Debt is up $147Tn in 20 years. That’s $7Tn a year or about 10% of our Global Economy has been debt-driven. Meanwhile, the Global GDP grew $50Tn over the same 20 years, which is $2.5Tn per year or 5% so, in simple terms, our debt is growing twice as fast as our economy.

This is why there is a global push for 0% interest rates – 1% of $225Tn is $2.5Tn – that’s 100% of our growth getting sucked up by interest payments. 2% would chop $2.5Tn off the growth, 3% rates would pull $5Tn out of the Global Economy, 4% $7.5Tn (10%), 5% $10Tn, 6% $12.5Tn… I know you can do the math but have you really thought about these numbers?

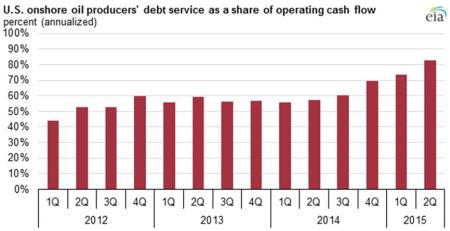

How can we ever go back to “normal” interest rates when just 3% would devastate the Global Economy? Just take a look at the energy patch, where the EIA is showing that US onshore oil producers’ debt service is already taking up 85% of the cash flow – even at these incredibly low rates:

This is much worse than last December (70%) and December is the month in which lenders are to reassess E&P companies’ loans conditions based on their assets value in relation to the incurred debt. Also, oil was $100 a barrel in mid-2014, so the oil companies WERE still swimming with cash at the end of last year – not so much this year – especially for those who squandered it on buybacks or weak M&A deals.

How long will this charade continue? Actually, it can go on for quite a while as long as the Fed, the ECB, BOJ, BOE, PBOC, etc. are all willing to keep playing. The ECB meets Thursday and it’s widely anticipated they will double down on even lower rates and even more Quantitative Easing, which will then open the door for another round of Global easing and rate reductions – game not over by a long shot.

As you can see, both Europe and the US are nowhere near Japan’s radical stimulus levels and China is also pumping it up at an amazing pace. So it will not be wise to stand in the way of the Central Banks if they are willing to push it for another year or so. As long as they keep pumping money in – some of it will find its way to the stock market – especially given how poor the alternatives are looking by comparison.

Leave A Comment