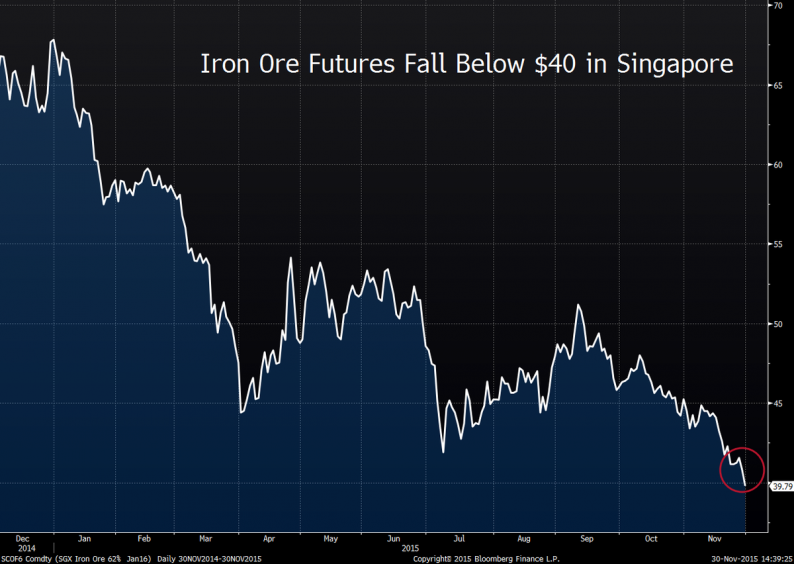

Last night’s Asian action brought another warning that the global deflation cycle is accelerating. Iron ore broke below $40 per ton for the first time since the central banks kicked off the world’s credit based growth binge two decades ago; it’s now down 40% this year and 80% from its 2011-212 peak.

As the man said, however, you ain’t seen nothin’ yet. That’s because the above chart is not merely reflective of too much supply and capacity growth enthusiasm in the iron ore industry or even some kind of worldwide commodity super-cycle that has gone bust.

Instead, the iron ore implosion is symptomatic of a much deeper and more destructive malady. Namely, it reflects the monumental malinvestment generated by two decades of rampant credit expansion and falsification of debt and equity prices by the world’s convoy of money printing central banks.

Since 1994 the aggregate balance sheet of the world’s central banks has expanded by 10X— rising from $2.1 trillion to $21 trillion over the period. This rise does not measure any kind of ordinary trend which temporarily got out of hand; it represents an outbreak of monetary insanity that is something totally new under the sun.

What it means is that the Fed, ECB, BOJ, People’s Bank of China (PBOC) and the manifold lesser central banks purchased $19 trillion of government bonds, corporate debt, ETFs and even individual equities and paid for it by hitting the electronic “print” button on their respective financial ledgers.

This central bank balance sheet expansion, in fact, represented 70% of the world’s entire GDP as of the time the print-fest began in 1994. Yet as an accounting matter this monumental expansion was inherently suspect .

That’s because the asset side was mushroomed by the acquisition of already existing assets — financial claims which had originally funded the purchase of real goods and services.

Leave A Comment