One thing investors in equities know is the market has essentially traded sideways for nearly two years. During this two year period, this sideways chop has included sharp pullbacks, one in late 2014, two in 2015 and the latest in February of this year. For long term investors this can be disconcerting for sure, so what headwinds are influencing the equity markets and will they subside any time soon?

For the most part no one factor contributes to the market’s ups and downs and I will not touch on all the potential influences, for example, the high level of debt being issued by the public sector, pension under-funding, the presidential election in the U.S., etc. At top of mind though are the following:

The oversupply of oil and the downward pressure it has placed on prices (until recently) has had a negative impact not only on the energy sector, but across other segments of the economy (industrial companies) that sell into the energy space. The energy weakness resulted in a contraction in earnings for companies in these segments. However, since oil price lows reached in February, crude prices are up over 80%. Whether this is sustainable is questionable, but, with higher crude prices, companies in the energy sector, and those that sell into the space, are likely to see better earnings versus last year.

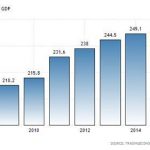

This leads to possibly the largest factor facing the market: earnings. As the below chart clearly details, double digit earnings growth in early 2014 turned into an earnings contraction. Combining the four quarters of 2015, the earnings for the S&P 500 Index were essentially flat. This contributed to a flat equity return for the S&P 500 Index for calendar year 2015. Since stock prices have a tendency to follow earnings over time, the trough in earnings in Q1 2016 may give way to earnings ‘growth’ into Q4 2016. One then asks, how is this growth possible. Two factors are occurring that may contribute to EPS growth from here.

One, the US Dollar strength that took place from mid 2014 and into 2015 has turned into weakness over the last 12 months. The result is multinational companies should experience less of a headwind from translating non US earnings back to the US Dollar.

Leave A Comment