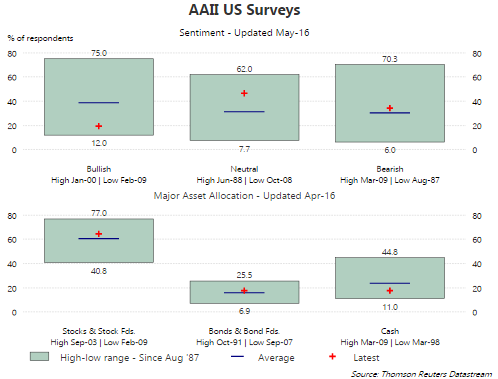

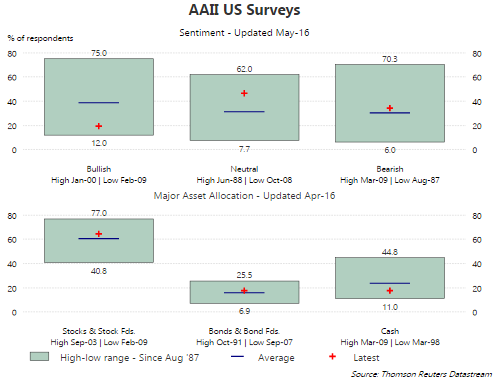

On a monthly basis the American Association of Individual Investors surveys its members on the asset allocation of their members investment holdings. In the April survey, on average, its members noted their equity exposure equaled about 64%, above the average of 60%. The bond allocation was equal to the long term average, while cash came in below average. What is interesting about these stated allocation responses is the AAII Sentiment Survey notes a near extreme low on individual investor bullish sentiment. In the Sentiment Survey report released this week, bullish sentiment was reported at 19.3%, which is far below the longer term average of 38.5%.

Recent mutual fund and ETF flow reports have noted the continued outflow in equity investments. Lipper’s report for the past week notes:

- “For the week equity exchange-traded fund (ETF) authorized participants pulled $1.7 billion net from ETFs. They added $942 million net to SPDR S&P 500 (SPY) while removing $1.2 billion from iShares MSCI Emerging Markets (EEM) and $1.9 billion from iShares Russell 2000 (IWM). Equity mutual fund investors pulled $2.2 billion net from their funds and brought the year-to-date equity mutual fund net outflows to $30.4 billion.”

- “Taxable bond mutual funds collected $2.1 billion of net inflows, of which high-yield mutual funds saw net inflows of $203 million and high-yield ETFs took in $931 million. Bond ETFs gathered $2.8 billion of net inflows. The week’s biggest individual bond ETF net inflows belonged to iShares iBoxx $HY Corporate (HYG, +$937 million).”

- “Municipal bond mutual fund investors added another $1.0 billion net this past week, for the first consecutive billion-dollar-week streak since January 2013. Money market funds saw net inflows of $10.7 billion for the week. Institutions added a net $8.5 billion, while retail added $2.2 billion.”

In spite of the lack of investor bullish sentiment and stated equity allocations that are higher than average, flow data and sentiment reports might be a better gauge of overall sentiment than looking at investor allocation responses.

Leave A Comment