Now that I am an honored member of the “gray-beard club” of investment managers, I can reminisce fondly back to the time when I first entered this business and began learning my trade with the utmost confidence of the “cute, fuzzy, teddy bear” youngster I was. I would like to share with you some thoughts of a few other “gray-beards,” but first I am going to share with you the story of “The Great Winfield” from Adam Smith’s The Money Game, first published in 1967. The story is a little long, but it is a very enjoyable and worthwhile read.

“My boy,” said the Great Winfield over the phone. “Our trouble is that we are too old for this market. The best players in this kind of market have not passed their twenty-ninth birthdays. Come on over and I will show you my solution.”

The Great Winfield is a friend of mine who is a tape-reader, super –speculator, and most recently, Marlboro-commercial rancher. That is, he has rejected the Wall Street identity of vests and haircuts for that of the Marlboro man. Ordinarily all you find in the Great Winfield’s country-sheriff-type office is four days’ worth of ticker tape on the floor and a few refugees from Establishment firms seeking a change of pace. Now, in addition to the usual denizens, I found three new faces in the Great Winfield’s office.

“My solution to the current market,” the Great Winfield said. “Kids. This is a kids’ market. This is Billy the Kid, Johnny the Kid, and Sheldon the Kid.”

The three Kids stood up, without taking their eyes from the moving tape, shook hands, and called me “sir” respectfully.

“Aren’t they cute?” the Great Winfield asked. “Aren’t they fuzzy? Look at them, like teddy bears. It’s their market. I have taken them on for the duration.”

The Great Winfield casually flicked some straw from his Levis. I don’t know where on Wall Street he gets the straw; he must bring it down in his pockets and then flick it off, piece by piece, during the day.

“I give them a little stake, they find the stocks, and we split the profits,” he said. Billy the Kid here started with five thousand dollars and has run it up over half a million in the last six months.”

“Wow!” I said. I asked Billy the Kid how he did it.

“Computer leasing stocks, sir!” he said, like a cadet being quizzed by an upperclassman. “I buy the convertibles, bank them, and buy some more.”

“You must be borrowing heavily,” I suggested.

“Not too heavily, sir!” said Billy the Kid. “I put up at least three percent cash. When I am conservative, I put up five percent cash.”

“Gee,” I said, “on the New York Stock Exchange you have to put up seventy percent cash.”

“We know hungry banks, sir,” said Billy the Kid.

“Isn’t that great? Isn’t that great?” said the Great Winfield, beaming. “Brings back memories, doesn’t it? Remember when we used to be in hock to the little Chicago banks?”

“I am awash in nostalgia,” I said. Billy the Kid said he was in Leasco Data Processing, and Data Processing and Financial General, and Randolph Computer, and a couple of others I can’t remember, except that they all have “Data Processing” or “Computer” in the title. I asked Billy the Kid why these computer leasing stocks were so good.

“The need for computers is practically infinite,” said Billy the Kid. “Leasing has proved the only way to sell them, and computer companies themselves do not have the capital. Therefore, earnings will be up a hundred percent this year, will double next year, and will double again the year after. The surface has barely been scratched. The rise has scarcely begun.”

“Look at the skepticism on the face of this dirty old man,” said the Great Winfield, pointing at me. “Look at him, framing questions about depreciation, about how fast these computers are written off. I know what he’s going to ask. He’s going to ask what makes a finance company worth fifty times earnings. Right?

“Right,” I admitted.

Billy the Kid smiled tolerantly, well aware that the older generation has trouble figuring out the New Math, the New Economics, and the New Market.

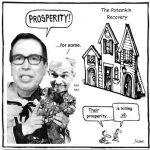

“You can’t make any money with questions like that”, said the Great Winfield. “They show you’re middle-aged, they show your generation. Show me a portfolio, I’ll tell you the generation. The really old generation, the gray-beards, they’re the ones with General Motors, AT&T, Texaco, Du Pont, Union Carbide, all those stocks nobody has heard of for years. The middle-aged generation has IBM, Polaroid, and Xerox, and can listen to rock-and-roll music without getting angry. But life belongs to the swingers today. You can tell the swinger stocks because they frighten all the other generations. Tell him, Johnny. Johnny the Kid is in the science stuff.”

“Sir!” Johnny the Kid said, snapping to. “My stocks are Kalvar, Mohawk Data, Recognition Equipment, Alphanumeric, and Eberline Instrument.”

“Look at him, that middle-aged fogey. He’s shocked,” the Great Winfield said. “A portfolio selling at a hundred times earnings makes him go into a 1961 trauma. He is torn between memory and desire. Think back to the fires of youth, my boy.”

It was true, I could hear the old 1961 Glee Club singing the nostalgic Alumni Song. “I loved 1961,” I said, I love stocks selling at a hundred times earnings. The only problem is that after 1961 came 1962, and everybody papered the playroom with the stock certificates.”

Leave A Comment