Remember this chart?

(BofAML)

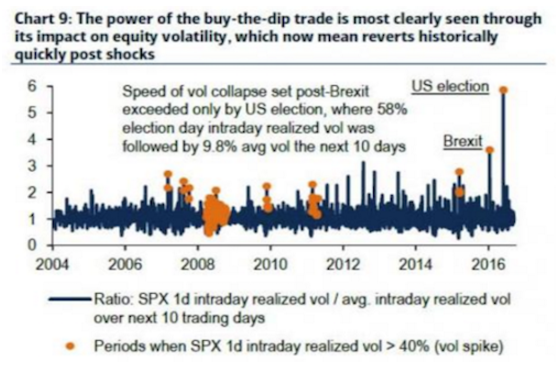

Yeah, so that’s become something of a mainstay among those of us who enjoy reminding market participants about just how absurdly efficient the central-bank-inspired BTFD trade has become. Basically that visual underscores a point Marko Kolanovic made a while back, which is simply that the time it takes markets to mean revert after geopolitical earthquakes is compressing over time and in the case of Trump’s November victory was reduced to mere hours.

Well on Monday we got what might be fairly described as a supercharged version of that dynamic when buy-the-populist-dip met market-friendly geopolitical outcome (see below for why this is kind of absurd on its face). The result was a VIX that fell 25% or, more colloquially, the biggest goddamn drop since August 2011.

Given all of that, you might be asking yourself “will vol be anchored again?”

Or maybe you aren’t asking yourself that. Hell, I don’t know.

But Goldman is asking that and for those interested, there’s some (possibly) useful commentary excerpted below.

Via Goldman

Of course the absurd thing about this – as alluded to above – is that vol apparently can’t remain elevated no matter what happens on the political front. Populist gets elected: vol crushed. Populist looks like she’s going to lose to a globalist candidate in a second round landslide: vol crushed.

Proximate cause:

(BofAML)

Leave A Comment