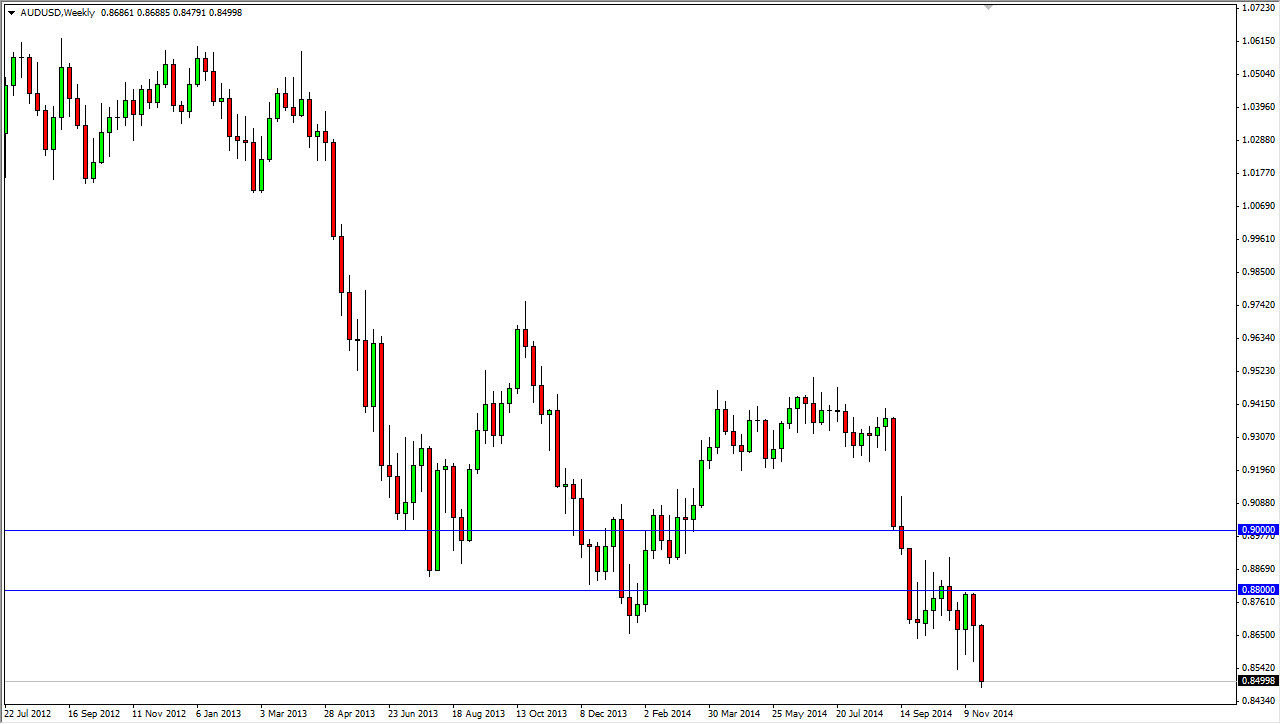

The AUD/USD pair fell rather significantly during the course of the week, slamming into the 0.85 handle. Now that it appears that we are getting ready to break down below it, I feel that the Australian dollar will continue to lose value going forward. It’s probably only a matter of time before we test the 0.80 level, so selling is the only thing that I plan on doing. In fact, I believe that there is a massive amount of resistance at the 0.88 level now, so I am selling rallies as well as the aforementioned break down.

EUR/USD

The EUR/USD pair tried to rally during the course of the week, but failed again at the 1.25 handle. The resulting action formed a shooting star, and that means of course that the market is more than likely going to continue going lower. If we can get a fresh, new low I think that we will then head to the 1.2050 region. Rallies will continue to be selling opportunities, and it is not until we get above the yellow box on the chart that I would consider buying the Euro, which is at the 1.30 handle.

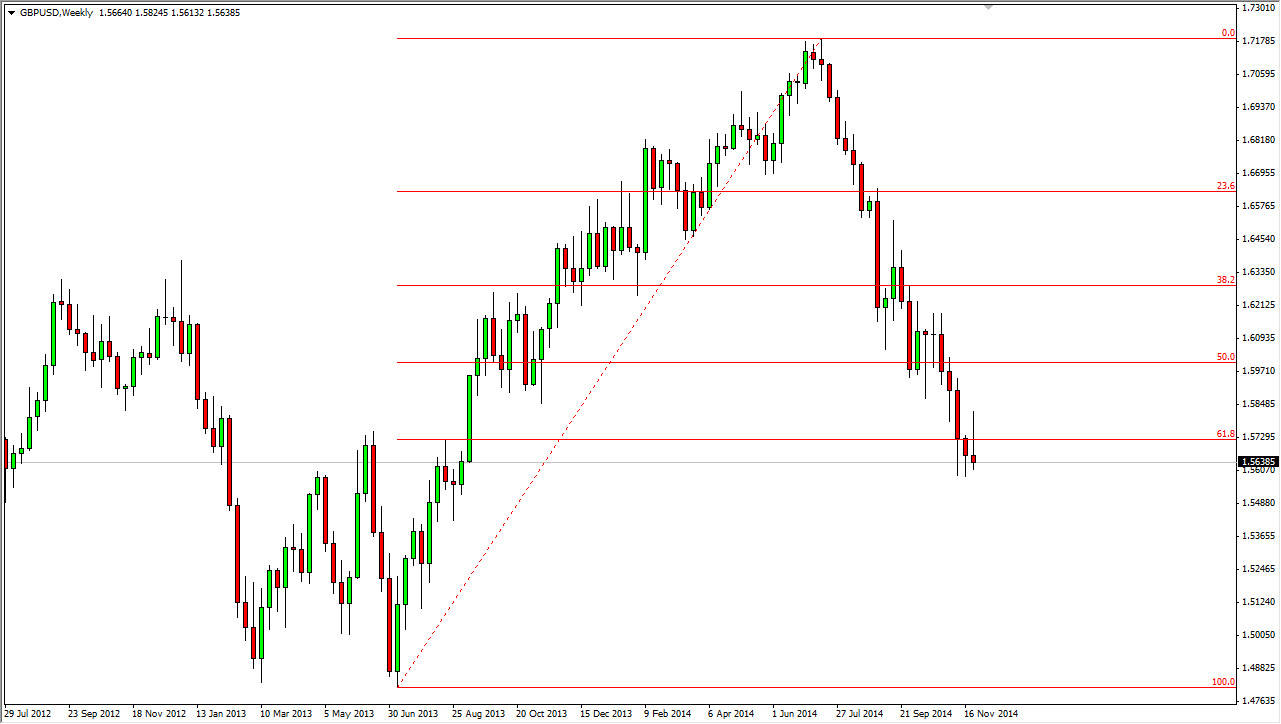

GBP/USD

The GBP/USD pair initially rallied during the course of the week, but as you can see failed to hang onto the gains and formed a massive shooting star. However, there is a lot of noise just below so although it looks bearish I am a bit on the cautious side about shorting this pair. Certainly when buy it though, there is most certainly a significant amount of bearish pressure in this particular market at the moment and the US dollar is by far the most favored currency in the Forex markets right now.

USD/CAD

The USD/CAD pair had a fairly positive week, using the 1.12 level as support. We now closed just above the 1.14 handle, and as a result it looks like were testing the recent highs again. If we can get above the shooting star from a couple of weeks ago, I feel at that point time we would test the 1.15 handle, and then of course probably much higher than that. Pullbacks should continue to be buying opportunities as the market is most certainly bullish, and we have no reason to think that the Canadian dollar is going to strengthen, especially considering how soft the oil markets have been.

Leave A Comment