As I was compiling background notes for the new semester, I found the current level and trend in the term spread of interest.

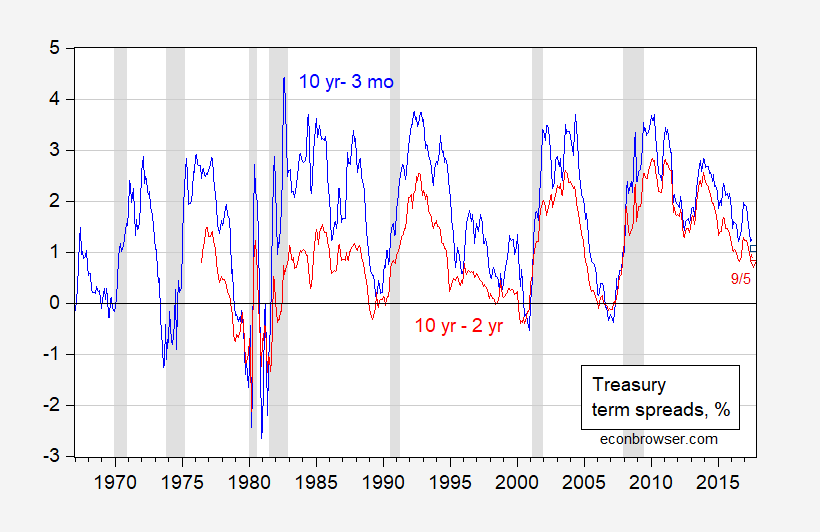

Figure 1: Ten year minus three month Treasury spread (blue), and ten year minus two year spread (red), %. Observations for September are 9/5. NBER defined recession dates shaded gray. Source: FRED, Bloomberg, NBER and author’s calculations.

Run the probit regression

recessiont+6 = -0.81 -0.474×(GS10-TB3MS)t + 0.065×TB3MSt + ut

over the 1967M01-2017M02 period (McFadden R2 = 0.24); the implied probability of recession is 10% for February 2018.

Using a specification without the level of the short rate included leads to a slightly higher probability, 14% or so.

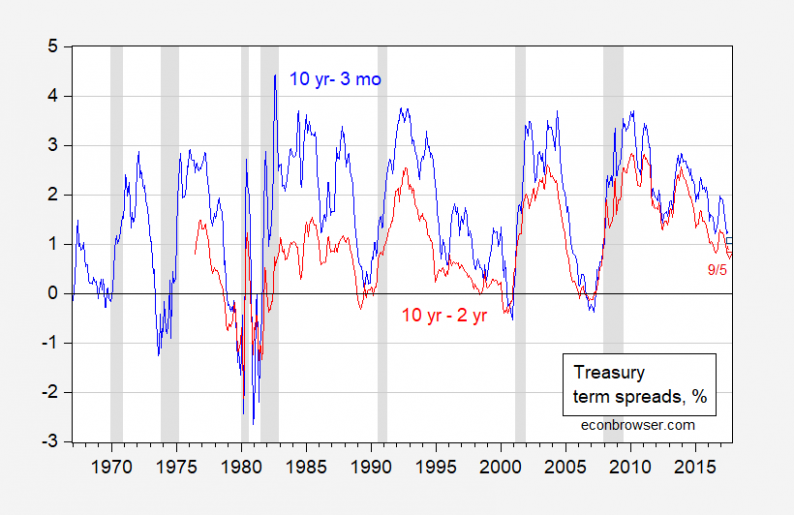

The detail is also interesting. The spreads are smaller than they were in October 2016.

Figure 2: Ten year minus three month Treasury spread (blue), and ten year minus two year spread (red), %. Observations for September are 9/5. Source: FRED, Bloomberg, and author’s calculations.

Leave A Comment