Semiconductor stocks were the star performers of the broader technology space in 2016 thanks to upbeat earnings, consolidation activities and innovative technologies. Areas like autonomous cars, 3D printers, fitness devices and IoT fueled growth in the sector, offsetting the otherwise-saturating businesses like PCs and smartphones.

As a result, semiconductor ETFs including VanEck Vectors Semiconductor ETF (SMH – Free Report) , iShares PHLX Semiconductor (SOXX – Free Report) and PowerShares Dynamic Semiconductors ETF (PSI – Free Report) advanced about 43.6%, 46.9% and 62.2%, respectively, in the last one year (as of April 19, 2017) (read: Will Semiconductor ETFs Repeat This Year’s Success in 2017?).

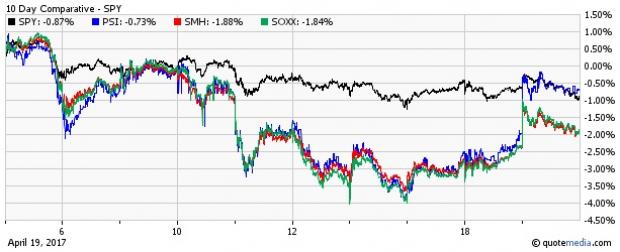

However, things have moderated in the space lately with most ETFs being in the red in recent trading sessions. Against this backdrop, let’s find out if semiconductor ETFs can be promising bets over the long horizon and if investors should buy this dip (read: 5 Hottest Tech ETFs of 2017).

Rebound in PC Sales

The PC market, which witnessed shipment declines over the past few years, seems to be on the verge of a turnaround. However, as per research agency IDC, global shipments of PCs increased for the first time on a year-over-year basis in the first quarter of 2017 in five years. The agency noted that PC shipments grew 0.6% year over year in Q1 of 2017. Though the PC market is not extremely active, it is in a stabilizing mode.

Rise of 4G LTE

Though shipments of smartphones have cooled down lately, the continued shift toward 4G LTE in high-end smartphones has boosted wafer demand of advanced process technologies, as per the research agency Gartner. Plus, the rapid deployment of fingerprint sensors and active-matrix dynamic light-emitting diodes (AMOLEDs) by Chinese smartphones should also give the space a boost, as per several research agencies including Gartner. Recently the agency indicated that consumer applications will likely make up for about 63% of the overall IoT applications in 2017.

Leave A Comment