The gold price moved up $18. However, the silver price moved up 60 cents which is a much bigger percentage. The silver community is getting pretty excited.

A market trend will often begin when a small number of traders learn something new. As they begin buying (or selling), the price begins to move. Others become aware of the truth, and they begin buying. There’s just one problem with these moves.

By the time most people hear about it, the fundamentals have changed. Oh the discovery may still be true, but the new, higher price offers no bargain.

For years, silver has been priced in the market above its fundamental (with a few momentary exceptions, such as one year ago). The fundamental price was way below the market, and led it down.

Then this summer, the market and fundamental inverted as the market price fell. The fundamental caught down to it by July 14. In the last week of August, another inversion occurred. The market price dropped through the fundamental, which was rising by then.

Now the market price has shot up, probably for two reasons. One is the persistent rumors of silvercoin shortages that people mistake for a silver bullion shortage. The other is the nonfarm payrolls report, which they interpret as a green light for more quantitative easing. Add to this the fact that thegold price is rising in the face of strong fundamentals, and people buy up silver.

Read on, for the only true picture gold and silver supply and demand fundamentals…

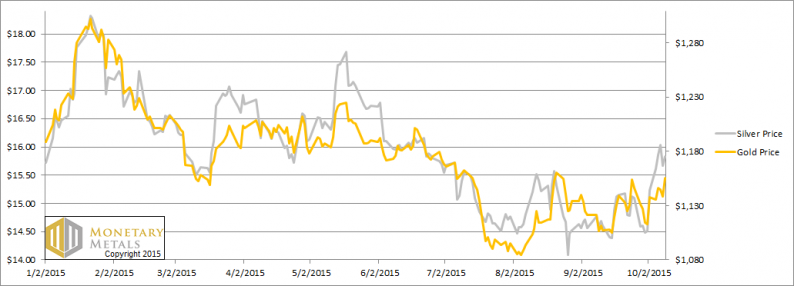

First, here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

Leave A Comment