Some folks are sounding pretty bearish on the euro of late, and it’s not hard to understand why.

The common currency rallied hard against the greenback in the first nine months of 2017, as a policy divergence story (hawkish Fed/supportive fiscal policy in the U.S. versus political risk in Europe and a dovish ECB that, to the extent they moved towards normalization at all, would be starting from behind anyway) morphed unexpectedly into a policy convergence story (lackluster inflation in the U.S. keeping the Fed gun-shy/stumbling block after stumbling block for Trump’s growth-friendly agenda versus receding political risk in Europe and a suddenly “hawkish” Draghi at Sintra).

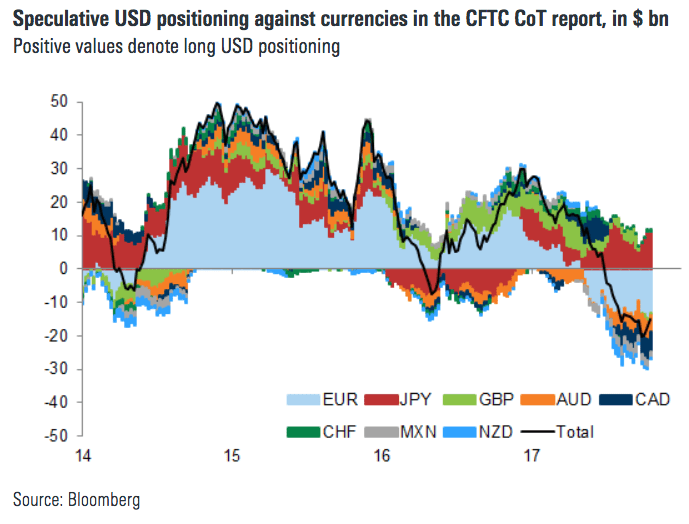

That led to a truly hilarious reversal in positioning. You can see it in light blue below:

Well now, despite the expected announcement of the ECB taper, it’s looking like the tables might turn again. With “progress” (or what counts as progress these days) on tax reform in the U.S., with the Fed hell-bent on squeezing in another hike this year, and with political turmoil in Italy and Spain raising the specter of euro breakup, there’s a palpable sense that EURUSD could be heading for a decline. Here’s Bloomberg’s Mark Cranfield:

Forex markets may look relatively calm, but that just masks the potential for a deep dive in EUR/USD. Political angst in Europe thanks to Catalonia and Italy contrasts with the growing optimism in Washington that a tax deal is possible.

That means the euro may not have to wait much longer to see the 1.16 handle. The ECB meeting this week is set to announce a tapering of bond purchases, but that will likely be wrapped in the most dovish language possible. Not something designed to bring much support to the euro. The October low at 1.1670 is the next level below which medium-term bulls could be forced to throw in the towel.

As we noted earlier, the periphery jitters are manifesting themselves in European equities. Have a look at the divergent paths European stocks have taken month-to-date (DAX, CAC, EuroStoxx on top, MIB and IBEX on bottom):

Leave A Comment