Show of hands: Who cares about momentum indicators?

My hand is not raised. That said, I’m taking a shine to perpetuating the mounting charges that I am a fearmonger, so I’m going to go ahead and play right into that characterization by showing you this:

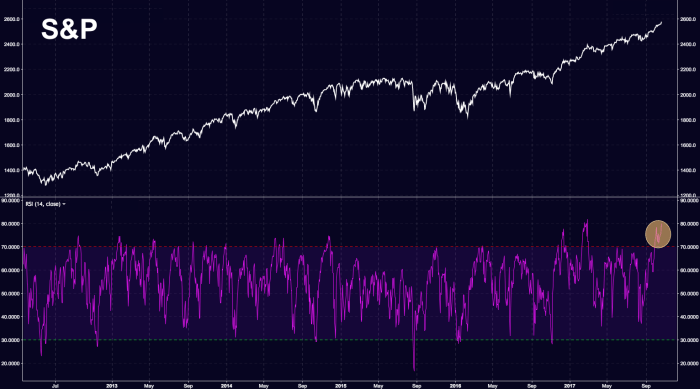

So that’s 15 straight days above 70 for the 14-day RSI and according to Morgan Stanley, that does not bode well going forward. Historically, the median decline over the next 30 days is 4.5% after this set up.

“Friday’s session in particular had the feel of a buying climax to us,” the bank writes, in a new note, adding that “a similar pattern on March 1st after President Trump made a well received first address to Congress marked a short term top and preceded a 3% drawdown in the S&P.”

Notably, that assessment comes from the most bullish analyst on the Street, Michael Wilson. He still thinks the S&P hits 2,700 by year end.

Oh, and meanwhile…

i see this is being characterized as a “chart crime”

because remember: suggesting that risk assets are a bubble is now illegal pic.twitter.com/NWEVW9yZIB

— Walter White (@heisenbergrpt) October 23, 2017

Leave A Comment