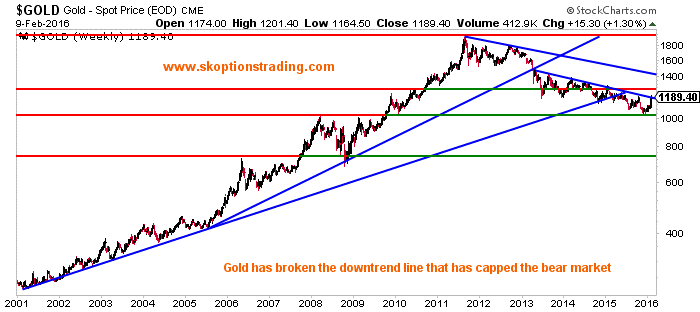

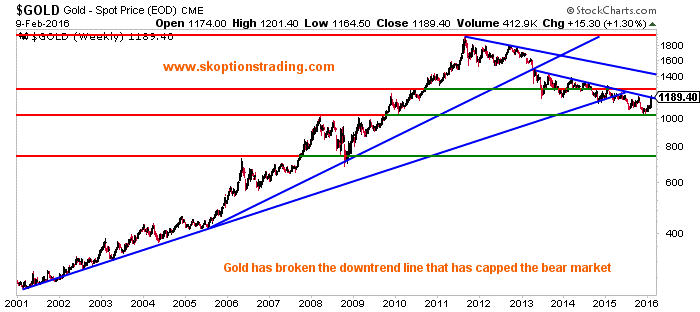

Gold has broken higher through its long term downtrend line with the most recent rally. This break begs the question of how much longer gold can continue rallying. In this article we analyse the technical situation for gold to determine at what level gold is likely to cease rallying, the fundamentals in play, and what would have to change to cause a new bull market in gold.

The Technical Limits for Gold

The peak in gold prices came in 2011 and trended lower after this, but the technical gold bull market did not break until April 2013. Since this break and the beginning of the bear market gold has had upward resistance from a downtrend line that has held steady despite a number of rallies in gold. However, gold has now moved above this resistance and, more importantly, closed above it.

Now that this level is broken the next major resistance is at $1275, then close to $1400 with the downtrend line that has been in place since the all-time highs were made in 2011. The question is, can gold challenge these levels?

The above graph shows every bounce that gold has made since it peaked and the magnitude of each bounce. The largest of the bounces saw the yellow metal rally 18.06% and gold is currently up 13.28% from the lows made last year. This means that if gold moves above $1250, then we will be in the strongest period for gold prices since 2011.

The Cause of the Current Bounce

For gold to sustain its strength and continue rallying above $1250 there will have to be a significant shift in the fundamental situation. The current movement can be accounted for by the removal of a key bearish catalyst: The Fed hiking.

Fears around China’s currency devaluation and a lack of inflationary pressures has caused a risk off tone in markets. While these volatile conditions persist the Fed will not hike rates, and will instead take a dovish stance as they did at their January Meeting. As a result market pricing for a single rate hike by the end of year has fallen to only 21%. This is in stark contrast to the situation following the rate increase in December, when the markets had priced in between two and three hikes and the Fed predicted at least four hikes would be required.

Leave A Comment