With US markets failing to hold on to today’s “Deutsche Bank” euphoric gains today despite, or rather due to Janet Yellen’s Congressional testimony, traders in mainland China remain locked out due to the Lunar New Year holiday, while Japan is mercifully taking a break – mercifully, because otherwise the Nikkei would be crashing. However, one market is back online as Hong Kong traders return to their desks to see carnage around the globe, and most importantly, are unable to hedge exposure between China, Japan and the US.

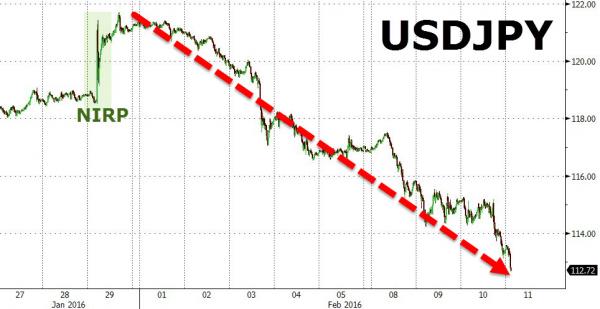

So, with few options, they are buying the one asset that provides the best cover to central banks losing faith, demonstrated most vividly by the total failure of the BOJ, and as a result just as Yen soars above 113… with USDJPY down a stunning 10 handles from the post-NIRP highs…

.. and Gold has taken out the numerous $1,200 stops…

and is currently surging to levels seen at the end of QE3…

What is causing this mad rush into gold is unclear, but… it’s probably something.

Meanwhile, as gold is soaring, its BOJ pair trade equivalent (as described in An Inside Look At The Shocking Role Of Gold In The “New Normal”) the USDJPY, just tumbled below 113 for the first time since 2014, and with no support levels until 110, this may just be the final straw not only for Kuroda but for the entire Abenomics house of hollow cards.

In any case, don’t expect the gold surge to last too long: our good friend, Benoit Gilson, manning the Bank of International Settlements’ gold and FX desk, will be on alert very shortly.

Away from currencies, WTI is also collapsing, to a $26 handle…

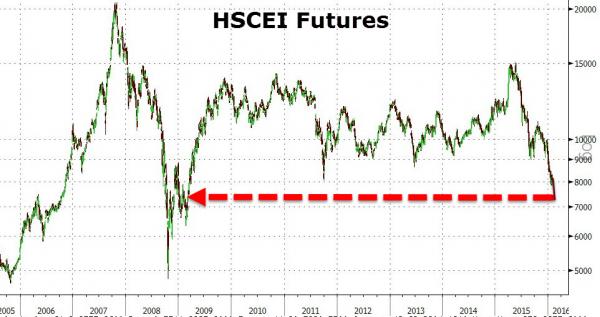

Asian equity markets are crashing…

With energy-related stocks crashing…

Leave A Comment