So often I see “value investors” who equate the conviction of their position and alacrity of their analysis for being able to pick a bottom in a hapless stock. If the bottom fails, sometimes these investors will continue accumulating stock with each buy delivering the welcome opportunity to lower their cost basis. Meanwhile, losses keep growing and momentum continues delivering greater and greater discounts. I have never been a value investor, but I have been on this losing end of an argument with the market. I have learned the hard way that my opinions and analysis mean nothing if the market sustains its disagreement with me.

Instead of arguing with sellers, bottom-fishers should celebrate with buyers. A bottom cannot happen when the most interested participants are sellers. It takes buyers to turn the tide of downward momentum. So, it makes sense to wait for signs of buying interest before making a move. It makes even more sense to let buyers PROVE that something fundamental has changed in a stock.

I have some charts of current trading situations to demonstrate these concepts.

Solar City (SCTY)

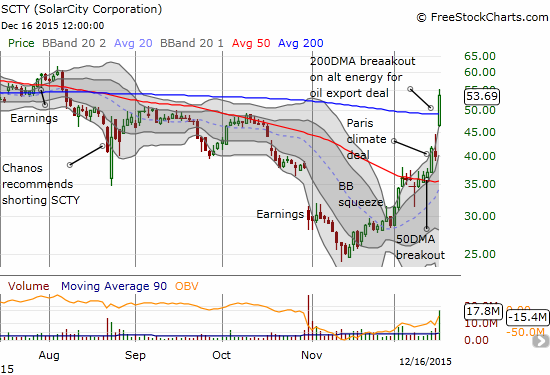

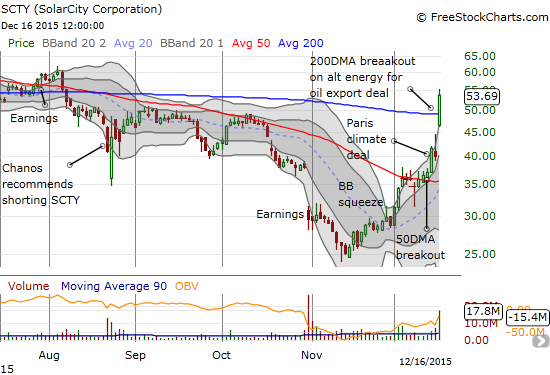

I have been pounding the table for SCTY for a while now. A month ago, I included SCTY in “Some Bullish Solar Stock Setups.” I cautiously pointed out that buyers finally showed up in the stock in volume. Given the large short interest in the stock, it was entirely possible this volume surge represented a rapid convergence of short-covering to lock in profits. At least the move printed a clear stop-loss at a new low. SCTY has not looked back since.

Solar City (SCTY) left its bottom a while back. It is now in a full throttle breakout.

This is the power of waiting out a downtrend until buyers make a convincing showing. In this case, two days of high volume buying was followed by a sharp day of selling that failed to generate follow-through or a new low. The momentum was shifting. At the end of November, a Bollinger Band (BB) squeeze appeared. A BB squeeze occurs when volatility suddenly compresses to create a stalemate between buyers and sellers. The resolution of this squeeze often creates fresh momentum. SCTY broke out to the upside. In three days, SCTY gained 29% and tested resistance at its 50-day moving average (DMA). The stock stumbled around its 50DMA for 5 trading days before resuming the upside push. I did not stick with my bottom-fishing trade through the 50DMA breakout; with hindsight, I am of course kicking myself bigtime.

Leave A Comment