The SPX equal weight touched the previous high and then reversed. Shooting star pattern? Now what happens?

There are a few weak spots in this market.

The recent chart of the Transports does not have the look of an uptrend. Not yet anyway. This has been one of the few major indexes not confirming the recent breakout for the stock market.

The US Dollar is not behaving well either. Strong economic growth usually means a strong currency.

We have a weak dollar and a weak CRB. That is unusual.

The Medium-Term

Did a new medium-term uptrend start on Monday? Based on this chart it sure looks like it did. But you have to be a little suspicious because the market didn’t correct by very much and it didn’t spend much time building a new base.

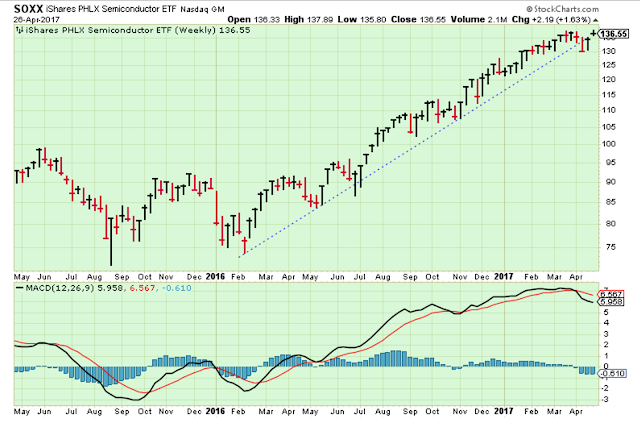

I think this chart is the key because the entire market is likely to follow this index.

It looks like a break down, but then a reversal. That could be a bullish set up if it occurred out of a strong base such as June 2016.

But this reversal is coming off of a long extended trend, and it just doesn’t have the look of a trend that can last much longer. It looks tired.

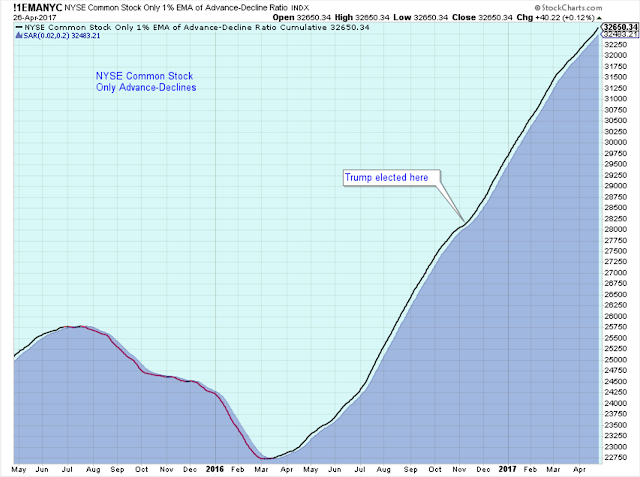

So you think it is a Trump rally?

The Leader List

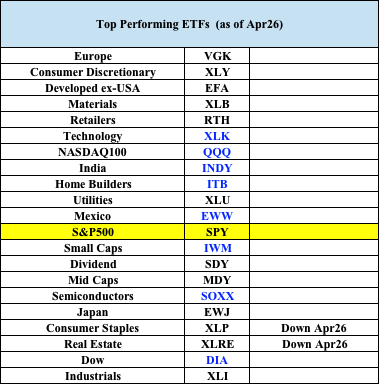

Two defensive ETFs dropped off the leader list today. Since Monday, the rally has focused back on growth. Also, the commodity-related foreign ETFs are all weakening. Mexico looked weak today.

Outlook

The long-term outlook is positive.

The medium-term trend is down as of March 21

The short-term trend is up as of April-20

Leave A Comment