Silver is currently trading around $17 an ounce. This is around 34% of its 1980 all-time high of $50. However, this is an incomplete representation of what silver is really trading at, relative to US dollars. When you look at the silver price, relative to US currency (the amount of actual US dollars) in existence, then it is at its lowest value it has ever been.

The US monetary base basically reflects the total amount of US currency issued. Originally, the monetary base is supposed to be backed by gold available at the Treasury or Federal Reserve to redeem the said currency issued by the Federal Reserve. This is not the case any more, therefore, the amount of dollars have grown exponentially over the years.

The lower the price of silver is relative to the monetary base, the more the currency is debased. The US dollar is now at its most debased it has ever been over the last 100 years, relative to silver (and gold). With all the excess dollars out there, the market will eventually seek an equilibrium, which means that silver will spike in price relative to the US monetary base, as it did in the late 1970s.

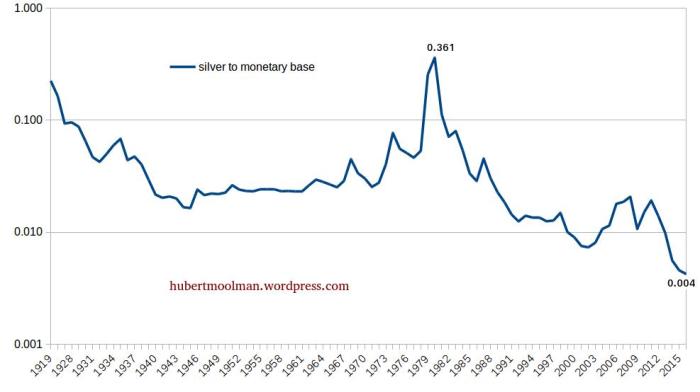

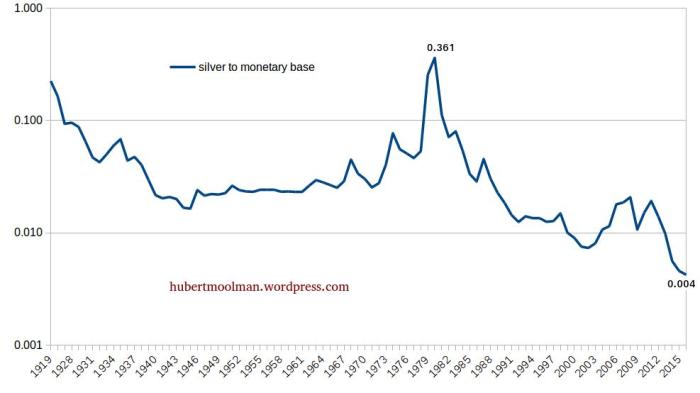

Below, is a long-term chart of the silver price relative to the US monetary base (in billions of dollars)

Note that the ratio, or price of silver, in terms of US dollars in existence, is indeed at its all-time 100-year low.

In 1980, the all-time high was 0.361, whereas the ratio is currently at around 0.004. The US monetary base is currently around 3 946 billion dollars (or 3.946 trillion). Therefore, if silver was today at its 1980 value, relative to the monetary base, it would be around $1 424 (3946*0.361).

So, in terms of US dollars in existence, silver is trading at 1.19% (17/1424) of its 1980 high – it is the bargain of the century.

There are many signs that point to the fact that the silver price is about to correct this situation, by spiking much higher. This will come about with a lot of financial pain, as I have pointed out on various occasions, especially since it will come with a massive debt collapse.

Leave A Comment