The exchange traded funds (‘ETFs’) universe has been expanding at such a pace that it is a challenge for an average investor to keep up with all the developments. According to the latest Global ETP Landscape report by Blackrock, there are currently close to 2,000 exchange traded products available in the US only. With multiple funds tracking fairly homogenous indices, market participants inevitably end up making sub-optimal choices in some cases. Occasionally there may exist a comparable ETF with a lower expense ratio and possibly better liquidity, which an investor may simply not be aware of. So how can one make sure that they have selected the most efficient fund for their desired exposure?

1. Search for related ETFs

There have been multiple times when I came to realize that there was a cheaper ETF available than the one that I have had in my portfolio for months. More often than not, this could have been avoided by simply googling for a list of ETFs in that specific category. One of my favorite tools is ETF Database, which classifies ETFs neatly and also offers a handy screener. However, there are situations where the answer may not be straightforward.

2. Search for correlated ETFs

Let’s take an example of iShares MSCI All Country Asia ex Japan ETF (AAXJ). It is a fairly popular ETF with over $2.7 billion of assets under management and a hefty expense ratio of 0.67%. The index it tracks sounds quite peculiar: it covers all Asian countries but excludes the second largest economy in the region. And this suddenly makes investor’s task of finding a related ETF much more difficult.

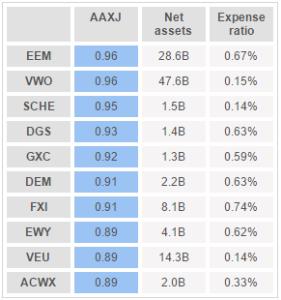

The solution in such a case is to search for the most correlated funds. Analyzing AAXJ with 5 years of historical data, the list of 10 most correlated ETFs looks as follows:

As can be seen from the table above, there are 3 ETFs that had a correlation of at least 0.95 vs AAXJ. This does not mean that their performance is or will be identical but they are definitely strong candidates to give access to the desired exposure.

Leave A Comment