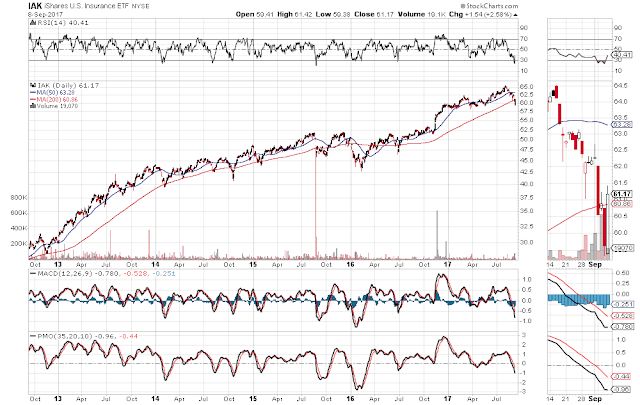

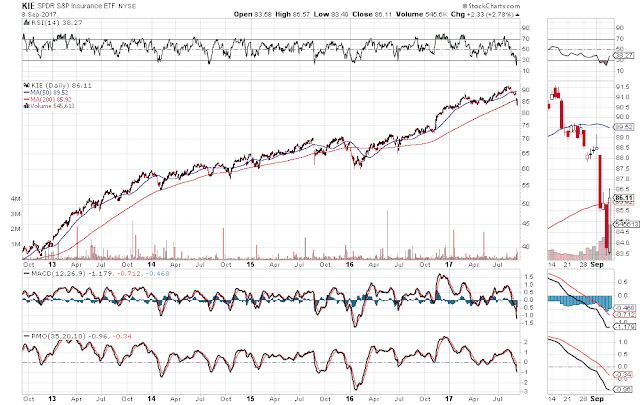

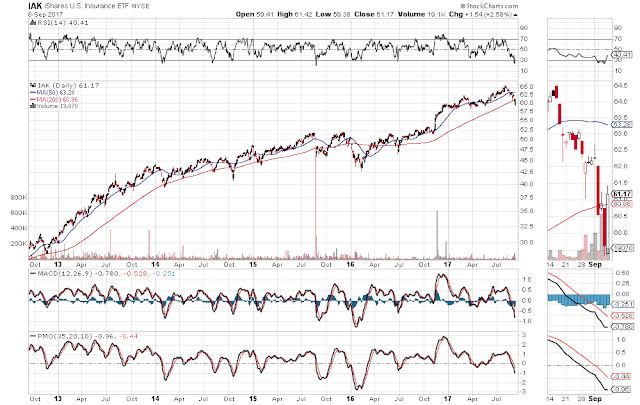

Price on three top Insurance ETFs has been dropping since mid-August, as shown on the following daily charts of IAK, KBWP and KIE. In the process, they made some extreme lower swing lows on each of their respective three technical indicators, suggesting that further weakness lies ahead.

As of Friday’s close, they are trading around their 200-day moving averages, so failure to regain an upward bias from that level could spell further sharp drops for these ETFs. Watch for any major volume spikes on further weakness to indicate possible panic selling. In the short term, we may, first, see a retest of their 50-day moving average (possible “Dead Cat Bounce”) before the next leg down occurs.

Leave A Comment