It is a very unusual week for data, with many of the major housing reports on tap and not much else. China’s GDP will be a big story over the weekend, and important earnings news will continue. Despite this, pundits will turn their attention to housing, asking:

Can a housing rebound signal “all clear” for the U.S. economy?

Prior Theme Recap

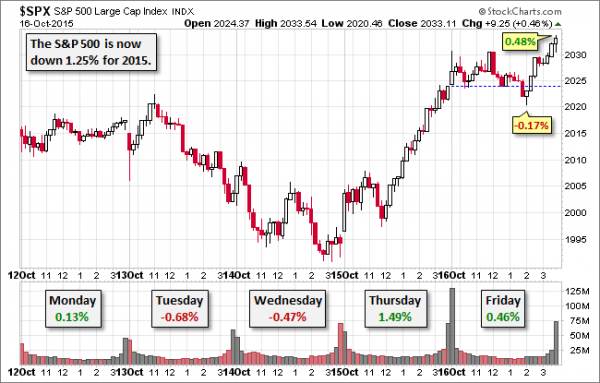

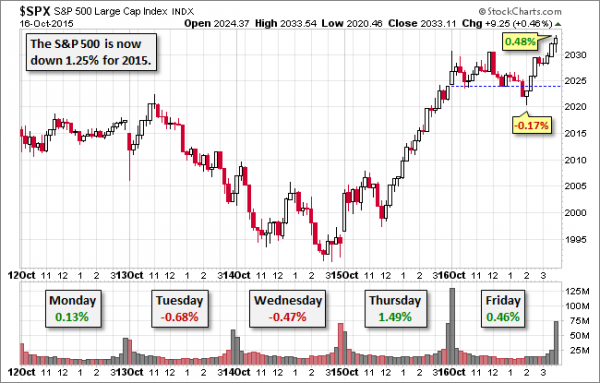

In my last WTWA I predicted that the story would be all about earnings, with a special focus on implications for the economy and prospects for 2016. Given the light economic calendar and the importance of this earnings season, it was an easy choice. It was a winning week for stocks, based mostly on Thursday’s big gains. To get the full weekly story, let us look at Doug Short’s weekly chart. This one saves more than a thousand words! (With the ever-increasing effects from foreign markets, you should also add Doug’s weekly chart to your reading list).

While I take a weekly focus, Doug’s update provides multi-year context. See his weekly chart for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

We have an unusually thin economic calendar, with many of the key housing reports in a single week. This should get some attention despite the earnings news.

Housing is important both as a reflection of consumer behavior (concurrent) and also as a driver of economic growth (leading). It is especially interesting since it is not related to the Chinese economy on first-order effects. As usual, there is a very wide range of viewpoints.

The week will also emphasize earnings reports. By the time you read this, I could also be completely wrong on the theme because of GDP news from China. The market may react to a “six handle” on the report (growth below 7%). Two CNBC anchors discussed this on Friday. One noted the many and varied reasons that the Chinese effect might be overstated. (See Kraneshares for an excellent report on this). The other replied, “The market doesn’t care about that.”

China might well be the story, at least for Monday.

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

There was a fair amount of good news and data.

The Bad

There was also some negative data, including some of the important earnings stories.

Leave A Comment