When I see an IPO of a new, potentially high yield stock, I add the company to my watch list. The goal is to find those companies that will pay an attractive yield and growing dividend for the subscribers of my Dividend Hunter newsletter.

Below you will find the details of four new companies that have come to market with IPOs in 2015. There is a diverse collection of business models among the four, with three of the four offering opportunities that are new to the publicly traded markets.

Communications Sales & Leasing Inc (NASDAQ:CSAL) is a real estate investment trust that invented a new niche in the REIT space. CSAL was spun-off by telecom company Windstream Holdings (NASDAQ:WIN) with an April 2015 IPO. The new REIT received basically all of WIN’s copper and fiber wireline assets. Those assets were leased back to Windstream on a 15-year triple net lease. Currently WIN is CSAL’s only customer. The company plans to grow by buying wire and fiber assets from other companies on similar sale-leaseback terms. I would wait on this one until it puts a few deals together. CSAL currently yields 11.8%.

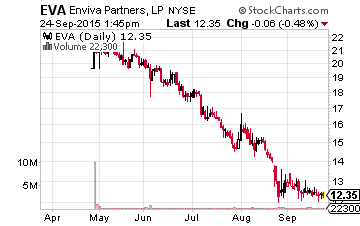

Enviva Partners LP (NYSE:EVA) is ready to profit from a unique renewable energy niche. The company produces and sells wood pellets that are used as fuel for electricity generation plants. EVA was also an April IPO. Company management claims that wood pellet sales are a growth business with demand increasing worldwide. Currently most of the demand for pellets is in Europe. Enviva owns and operates five production plants in the Southeastern U.S. The market does not see much value in the business, and the share price is down 40% from the IPO, pushing the yield to over 13%. Enviva has only paid one quarterly distribution, so this is really a watch and wait idea for conservative investors, or a very attractive yield for those who are willing to take on a higher level of risk.

Fortress Transportation and Infrastructure Investors LLC (NYSE: FTAI) was spun-out with a May 2015 IPO by Fortress Investment Group (NYSE: FIG), a diversified investment company. FTAI owns a diverse portfolio of assets including an energy product terminal, a small railroad company, rail cars, passenger aircraft, jet engines, offshore energy support vessels and almost 150,000 shipping containers. Revenues come from either operating the assets directly or leasing them out. FTAI currently yields 10.5%.

Leave A Comment