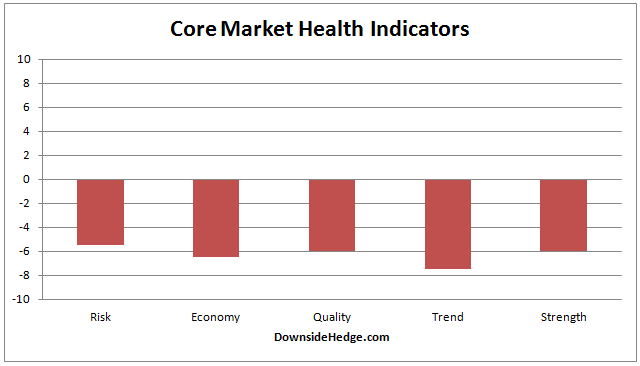

Over the past week all of my core market health indicators fell. They continue to be mired in negative territory and aren’t responding much when the market rallies. My market risk indicator is also still negative, however, it continues to improve. It will take some positive price action next week to clear the warning.

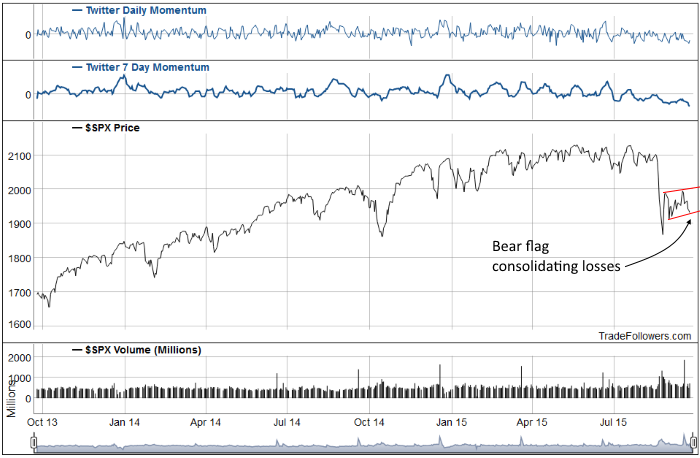

One thing of note is that a daily chart (closing prices) of the S&P 500 Index (SPX) appears to be painting a bear flag that is consolidating the August losses. This pattern has high odds of breaking lower. If that occurs then we’ll almost certainly see the August lows again and have a high likelihood that they won’t hold. That would put 1800 to 1820 on SPX in play as the first area for a bounce. If the market makes it back to the August lows I’ll take more profit from the hedge and soften it again…just in case the lows hold.

Conclusion

Core indicators are falling while risk is abating. Meanwhile, SPX is painting a bear flag. It’s time for patience. Wait for the risk warning to clear or the bear flag to break lower. Until then, I’ll keep my aggressive hedge in place.

Leave A Comment