Fundamental Forecast for USD/CAD: Neutral

– The Canadian Dollar has been looking forward to this week since the October elections.

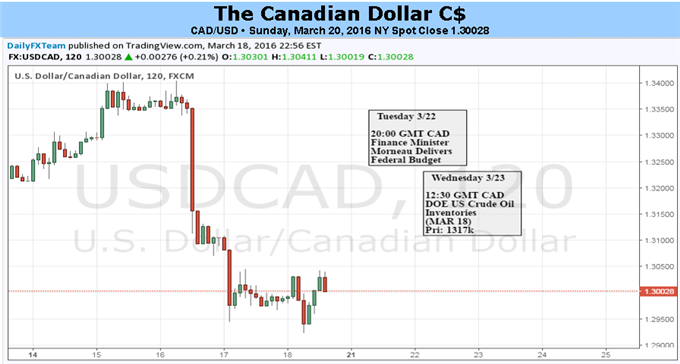

– Crude Oil remains a significant driver for USD/CAD.

– As market volatility ebbs, it’s a good time to review risk management principles.

To receive reports from this analyst, sign up for Christopher’s distribution list.

Certainly, for the Canadian Dollar, the last few months of “Waiting for Trudeau” have proven far more exciting than the tedious events that unfolded in Samuel Beckett’s “Waiting for Godot.” Since the January 20 Bank of Canada meeting, the Canadian Dollar has been on nothing short of a tear: USD/CAD has plunged by -10.3%; EUR/CAD is off by -7.2%; GBP/CAD has is down by -8.6%. Perhaps the strongest sign of the Canadian Dollar’s resiliency since the January BOC meeting: CAD/JPY is up by +6.4%. Why?- the BOC signaled that an event on the horizon represents a major policy turning point for the Canadian economy,

The moment the Canadian Dollar has been waiting for is indeed on the horizon: the new federal budget announcement brought forth by the government under new Prime Minister Justin Trudeau (Finance Minister Bill Morneau will unveil the budget – akin to Chancellor of the Exchequer George Osborne revealing the UK budget last week). Markets have been building up expectations for a new swath of policy measures aimed to help support the Canadian economy for a while now, at least since October 2015, when the Liberal party swept elections into power.

Yet the real turning point came in January 2016, which was a step towards crystallizing the hopes brought forth in October: the Bank of Canada announced that it was withholding further monetary easing in advance of impending changes to the federal budget. Regarding the expected shift in policy, we immediately suggested that the acknowledgement of the policy pivot “should be to the Canadian Dollar’s benefit over the long-term.”

Leave A Comment