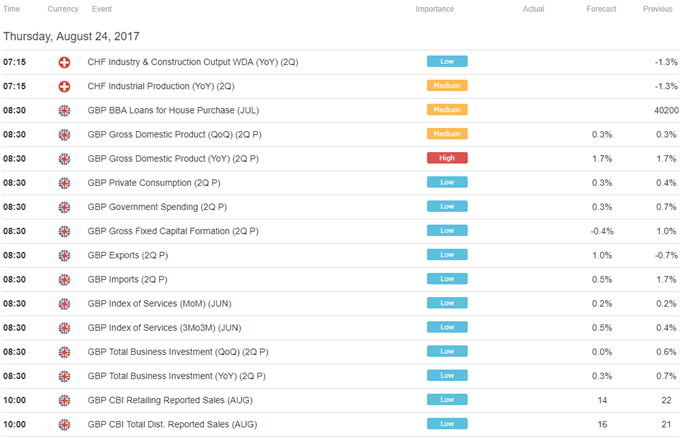

A revised set of second-quarter UK GDP data headlines an otherwise quiet European economic calendar. Preliminary forecasts showing output added 0.3 percent in the three months to June are expected to be confirmed. Absent a major deviation from expectations, the outcome seems unlikely to trigger a lasting response from the British Pound considering its limited implications for near-term BOE policy.

A smattering of US statistics are due to hit the wires later in the day but the second-tier releases on offer are likely to be overshadowed by the start of the Fed’s annual monetary policy symposium in Jackson Hole, Wyoming. Heavy-hitting speeches from Chair Yellen and ECB President Mario Draghi are due Friday and investors will likely opt against making strong direction bets until those have passed.

The G10 FX majors put in a mixed performance in Asia-Pacific trade. The Japanese Yen corrected gently lower having soared against a backdrop of risk aversion in the preceding session. The perennially anti-risk currency hit a two-month high against an average of its major counterparts after a worrying speech from US President Donald Trump at a rally in Phoenix, Arizona soured market sentiment.

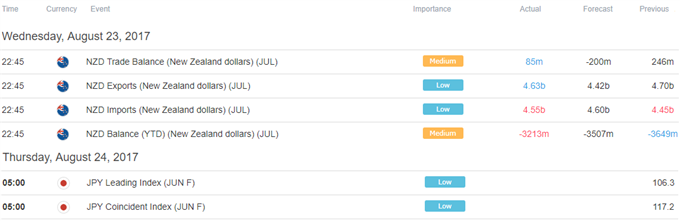

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment