(Photo Credit: nosha)

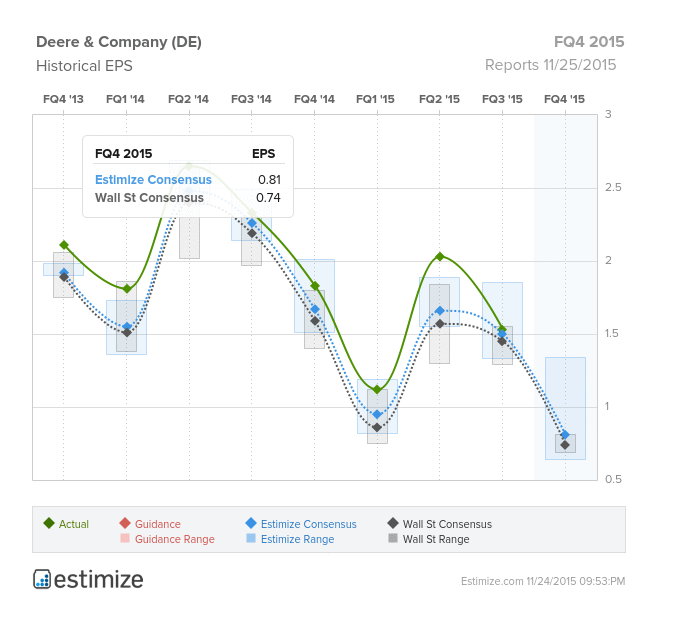

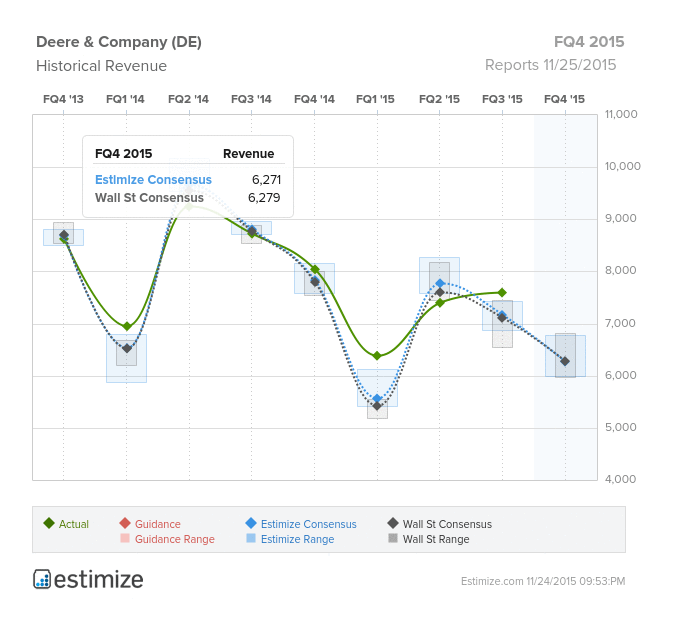

Deere & Company (DE), manufacturer of agriculture and construction equipment, reports fiscal fourth quarter results before tomorrow’s opening bell. Currently, the Estimize earnings consensus is a decent clip ahead of Wall Street’s. The Estimize community is calling for EPS of $0.81 vs. the Street’s $0.74. However, Estimize is looking for lower revenues of $6.271B as compared to the Street’s $6.279B.

The third quarter season was a rough one for the Industrials, and more specifically Machinery companies like Deere. Large names such as Caterpillar (CAT), Texas Instruments (TXN) and Cummins (CMI) were crushed once again when they missed estimates due to the strong U.S. Dollar and global weakness. Pentair, Inc. (PNR) even had an Estimize revenue consensus that was lower than the Street’s, which the company still missed by $40M. Of the 12 machinery companies in the S&P 500 index that have reported thus far (all but Deere and Joy Global), a majority have beat on earnings (7), while all but one have missed on revenues.

Deere knows well the headwinds they’re up against, lowering guidance for the rest of the year. In their last quarterly release, the company predicted equipment sales would decline 24% in FQ4 2015 on a year-over-year basis, including a 5% negative impact for foreign currency translation, and 21% for fiscal 2015 including a 4% negative currency impact. Just days after this report, the U.S. Department of Agriculture (USDA) announced that farm incomes are expected to drop 36% in 2015, the lowest level in 9 years, due to a decrease in crop prices and weakness in dairy markets. To offset losses linked to equipment sales, Deere has increased the amount of used machinery they lease to farmers who are undoubtedly cash conscious at this time.

Deere’s Construction & Forestry segment isn’t faring much better, falling 13% in the latest quarter, and projected to drop 5% overall for the year, including a 3% negative currency translation impact. The company attributed this forecast to “weakening conditions in the North American energy sector, as well as lower sales outside the U.S. and Canada.” However, forestry in particular is expected to see gains in Europe.

Leave A Comment