T2108 Status: 65.4%

T2107 Status: 30.9%

VIX Status: 15.1

General (Short-term) Trading Call: Neutral (target of 1996 on the S&P 500 occurred ahead of overbought conditions. See “From the Edge of A Breakout to the Ledge of A Breakdown” for more details).

Active T2108 periods: Day #11 over 20%, Day #10 over 30%, Day #10 over 40%, Day #8 over 50%, Day #4 over 60% (overperiod), Day #325 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

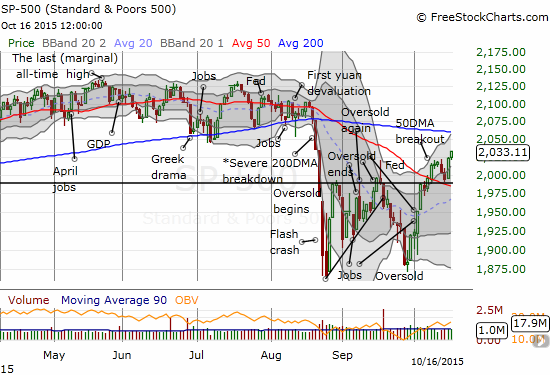

The S&P 500 (SPY) made a small breakout on Friday, October 16th. With a close of 2033.11, the index sits almost exactly where it sat the day before the first oversold period began during the August angst.

The S&P 500 breaks out ever so slightly to finish a complete reversal of the all the previous oversold periods.

The volatility index, the VIX, reinforces the potential importance of this move. The VIX gapped down right above the 15.35 pivot and eventually closed right below it. This move marks and confirms the END of the August angst.

The VIX is back into the “all is well” zone – below the 15.35 pivot line.

The NASDAQ (QQQ) is still lagging as it has not yet broken the intraday high from September. However, it HAS broken through its down trending 50DMA – a bullish sign.

The NASDAQ has confirmed a 50DMA berakout but has yet to make a new (intraday) high in this post oversold period

Despite the good signs, T2108 did not follow the market higher. In fact, I daresay my favorite technical indicator SHOULD have hit overbought territory. Instead, T2108 retreated ever so slightly to 65.4%.

Leave A Comment