Having been crushed by his Valeant exposure, today there was finally some good news for the embattled hedge fund manager.

Speaking on an investor conference call Ackman said Valeant is now on track to deliver its delayed 10-K by month end which will likely give the company a shot in the arm because investors will look at the company anew, according to Reuters.

Apparently this is sufficient to ignite a monster squeeze which has seen the stock soar from its $29 opening price to the mid-$30s.

This follows yesterday’s announcement by the board’s ad hoc board committee which cleared the company of any further wrongdoing; incidentally this is the same board which can’t even limit the presence of a dissident member, namely former CFO who has refused to quit the board despite being scapegoated by Valeant for everything that has gone wrong with the embattled pharmaceutical and now burst roll-up over the past 3 years.

William Ackman on Wednesday said the board of Valeant could find a new chief executive officer in “weeks” and said the stock will become “investable” again once the annual report is filed.

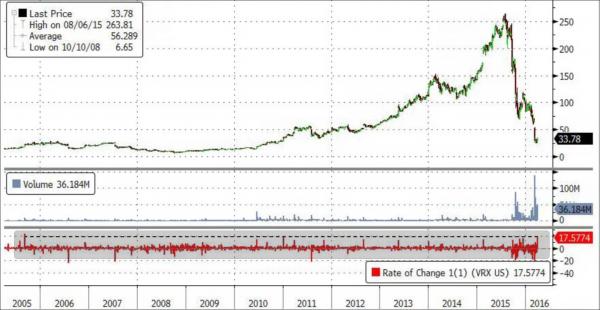

That remains to be seen, but it certainly appears investable if only for this moment: earlier today VRX stock was up nearly $6, jumping some 20%, for its biggest intraday surge since September 2005. At last check it was up 17%, although that sounds bigger than it actually as the following chart clearly demonstrates.

Those who missed it, can hear a replay of Ackman’s call at the following page.

Leave A Comment