Sterling is trading strongly ahead of Thursday’s Bank of England meeting which suggests investors are positioning for optimism but before the BoE meets, we’ll have to get past a few key economic reports that will shape policy expectations. Although the central bank recently downgraded their inflation outlook a smaller decline in shop prices and faster price growth in the manufacturing and service sectors in August point to a recovery. We also expect employment report to be strong as the service sector reports the strongest job creation in 19 months. Manufacturing reported the strongest since June 2014. We like buying GBP versus the Swiss Franc because the Swiss National Bank who meets this week will continue to call for Franc weakness.

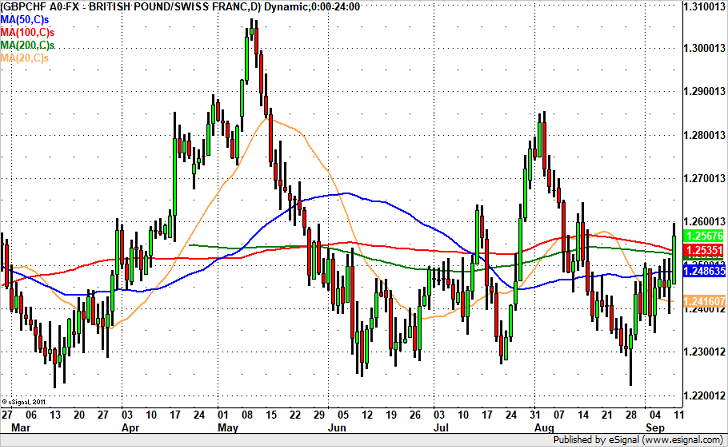

Technically, GBP/CHF has broken above the 20, 50, 100 and 200-day SMA. This signals the potential for a much stronger rally that tests the August 15th and July 17th high near 1.2640. If that resistance level is broken, the next stop should be 1.2700

Leave A Comment