Bad news is once again good news… for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, and said there is no basis for further Yuan devaluation, something the PBOC has consistently implied over the past year, despite two sharp devaluation episodes. That said, for Xiaochuan to break a very long silence, shows i) just how serious the threat of devaluation for China is and ii) how eager the PBOC also is to jawbone risk higher.

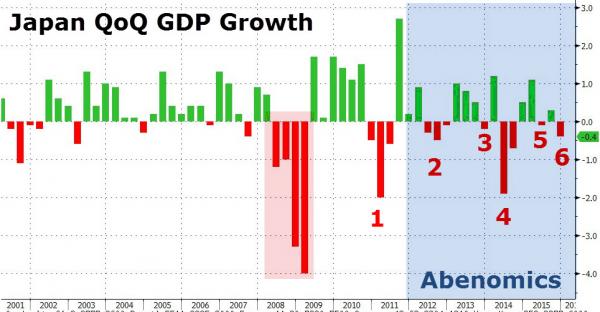

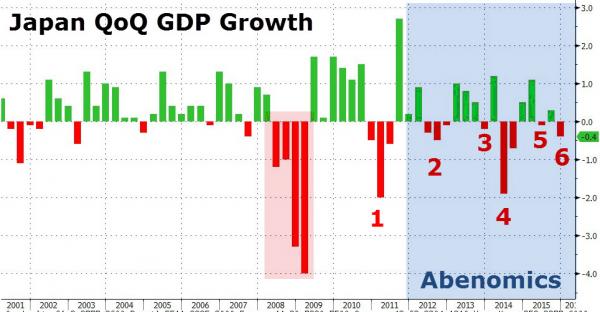

And while further devaluation is guaranteed, for now traders decided to take advantage of this verbal intervention and ignore the worst Japanese GDP data in over a year, when as reported last night, the country’s economy contracted at a -1.4% annualized rate, far worse than expected -0.8%…

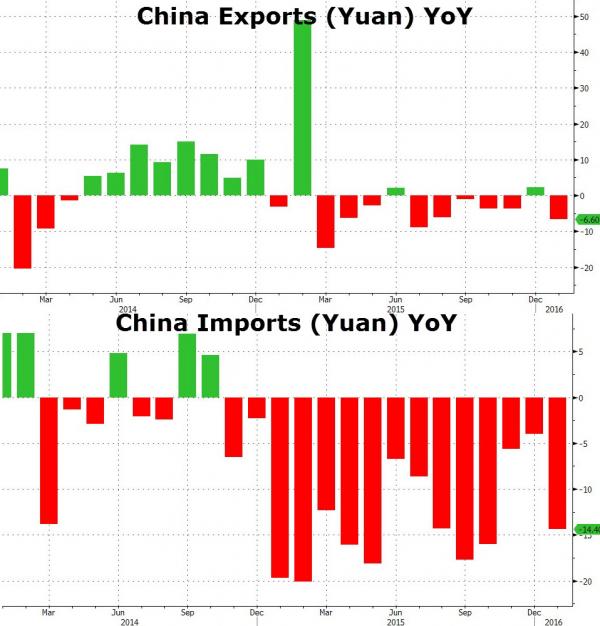

… as well as to ignore the worst Chinese trade data, with both exports and imports

coming below the lowest Wall Street estimate, since August…

… when just days after the trade report the PBOC proceeded with its first devaluation. The data was so bad it managed to push the Shanghai Composite nearly into the green after opening down nearly 3% on a delayed catch up to the rest of the world selloff.

The result of all this terrible economic data: hopes for more stimulus around the globe, and mostly in Asia, with bank concerns (especially of Deutsche Bank) that more stimulus is not what the global financial system needs soundly ignored for now.

The following quotes summarizes the catalysts for today’s move best:

“The Chinese market didn’t react as bad as we feared and with the weak export data there is some big hope that he central banks will react quite fast,” John Plassard, senior equity-sales trader at Mirabaud Securities LLP in Geneva, told Bloomberg. “It’s a mix of hope of intervention from the Asian central bank, short squeeze and also a relief in some energy and banking sectors, the most shorted sectors.“

And there are your catalysts for today’s surge: hope of more central bank intervention and a global short squeeze.

So back to square one.

The immediate result was the biggest Yuan surge since 2005, climbing 1.2 percent from its Feb. 5 close to 6.4942 per dollar in Shanghai; the biggest jump in Japanese equities since October 2008 on the heels of the Nikkei’s 7.2%, or 1,070 point jump; the biggest spike in the MSCI Asia Pacific Index since 2009, a continuation of Friday’s rally in Europe with the Stoxx 600 up over 3% led by financials, and even WTI jumped nearly 2% to rise back over $30 this morning, despite being lower most of the session on renewed excess supply concerns now that Iranian tankers are en route to their destination.

Among the other oil price drivers overnight, was Iran sending its first oil cargos to offshore destination after the lifting of sanctions: South Korea imports from Iran reach 2-yr high as Saudi imports fall. Iran average oil exports at 1.3MM b/d; to climb to 1.5MM b/d by end of current Iranian year at March 20, to 2MM b/d soon after: Shana cites 1st VP Eshaq Jahangiri.

Just as important, China January crude imports fell 4.6% to 6.31m b/d, the lowest in 3 months, down from record in December, as even Chinese oil storage capacity fills up. Chinese oil product imports +13.3% at 2.66MM mt, exports +45% y/y 3.01MM mt.

While the US is closed for President’s day, US equity futures are open until noon Central Time, and at last check were up 1.6%, or 29 points to 1,888, piggybacking on the global euphoria.

A quick recap of market closures in the US for Presidents Day:

For the recap of global markets, we start in Asia where stocks traded mostly higher following last Friday’s gains in Wall St. where outperformance in financials and a resurgence in crude, which posted its largest one-day gain since 2009, lifted markets from last week’s early turmoil. Nikkei 225 (+7.2%) outperformed, led by financials and energy, while ASX 200 (+1.64%) was supported by commodity-based sectors, which also followed from last week’s 5.6% rally in gold prices. Mainland China bucked the trend with the Shanghai Comp (-0.63%) negative as it played catch up to last week’s losses, with poor export trade data adding to its sombre tone. JGBs traded lower tracking T-notes as the increase in risk sentiment spurred outflows from safe haven assets.

Leave A Comment