Recession calls will once again be proved false……

“Davidson” submits:

In spite of wide spread fear that the global economy is collapsing, a majority of forecasts that recession is upon us and that markets will fall to as low as 5,000 (Dow Jones forecast by some), the US economy reflects nothing but expansion. Multiple reports the past 10days support the view that economic expansion is alive and well. Today, New Single Family Home Sales were reported with a Monthly Supply at 5.2mos. The chart shows the strong correlation with Residential Construction Employment. As long as we remain below 6mos supply of Single Family Houses for Sale, Demand remains in excess of Supply and demand for labor in the sector continues to rise. Housing sales reflect economic activity as it reflects lending to individuals based on assessments of the credit quality of individual borrowers. Good news!

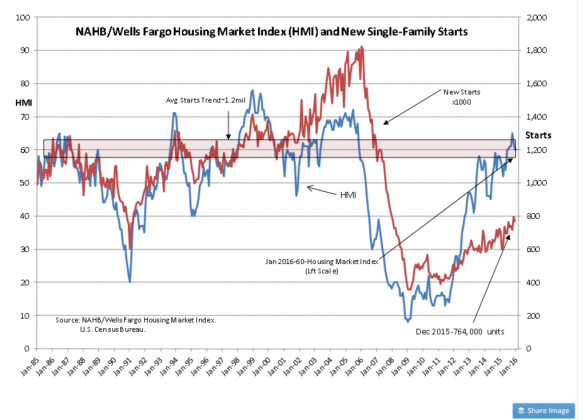

The Housing Market Index (HMI) is a sentiment indicator of home builders, but has been well correlated to Single Family Home Starts. The HMI is one of the few sentiment indicators which correlate well with economic trends. The HMI remains high and New Single-Family Starts continue to expand. The combination of the Single Family Monthly Supply of Homes for Sale with HMI provides very good insight to our housing market. The housing sector expansion continues. Good news!

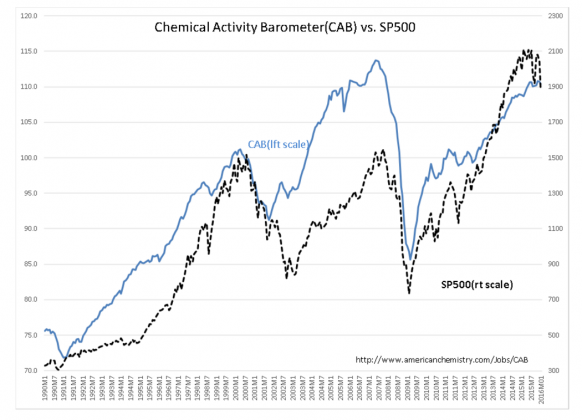

Last but not least is the Chemical Activity Barometer(CAB) which is shown correlated with the SP500. Chemical manufacture and use are basic to economic activity in a modern society. Housing is one sector which consumes chemical based products from carpets and furniture to plumbing, roofing, insulation and etc. Vehicle manufacture is another large consumer of chemical based products including paints, plastics, fabrics and fluids other than oil and fuel. Yesterday’s report revised past months higher. The up trend is clearly visible even with the recent dip in the SP500. More good news!

The saying goes, “The market has predicted 9 of the past 5 recessions.” Market forecasters the past 6yrs have predicted economic recessions at least 10x. History is on the side of economic trends predicting over all market direction. But, this is a long term correlation not month-to-month or even year-to-year. Eventually, a rising economy turns everyone bullish and drives market prices higher. It is economic trends which provide the early indications that recessions are ending. It is economic trends which provide the early warnings that economic peaks are developing. Market have always followed!

Leave A Comment