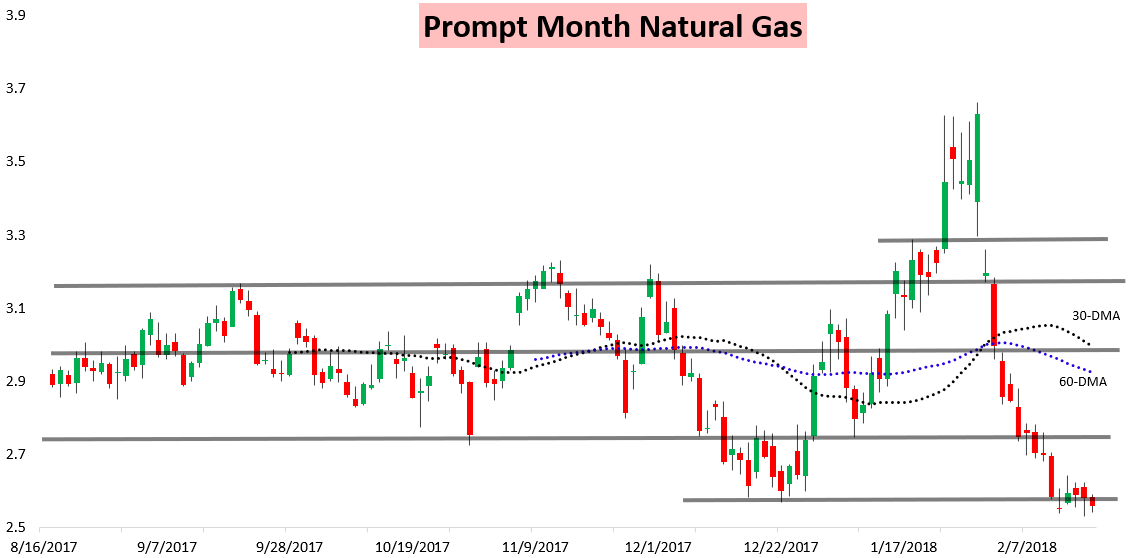

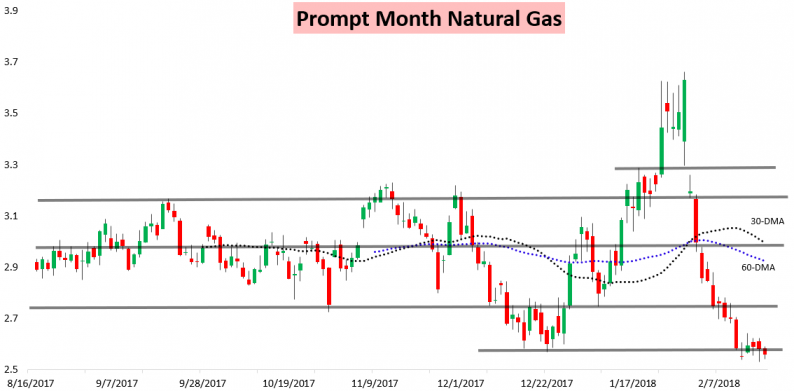

It may only be February 16th, but along the East Coast it already feels like spring, and the natural gas market is similarly already trading like it’s spring. The March contract traded within an incredibly narrow 5-cent range today, settling down less than a percent.

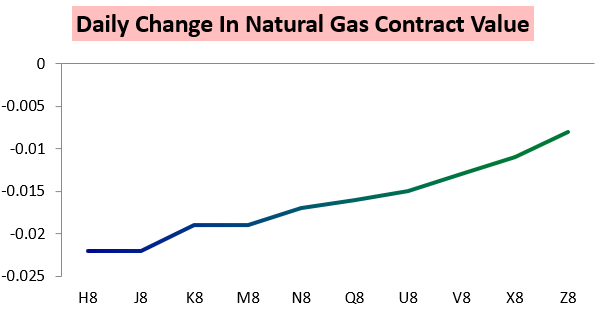

Losses were most sizable at the front of the strip, as we saw significant warm trends yet again on overnight model guidance that were further confirmed on afternoon guidance.

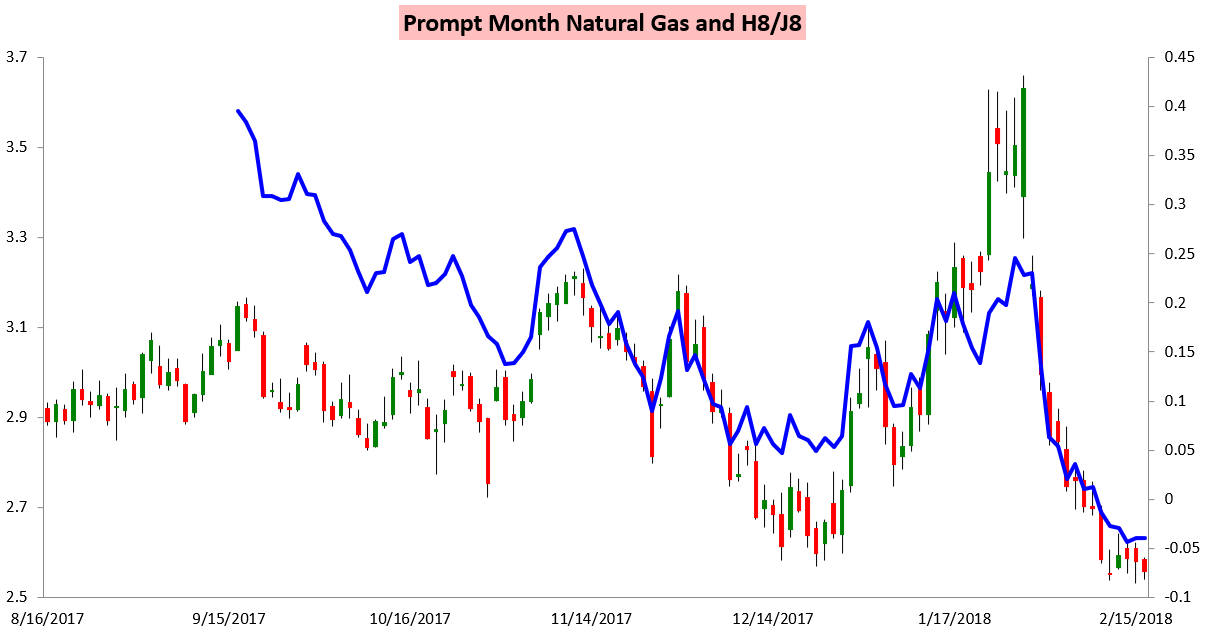

Yet the market does appear to be shifting focus to spring trading already, with H/J relatively flat the last couple of days despite further GWDD losses.

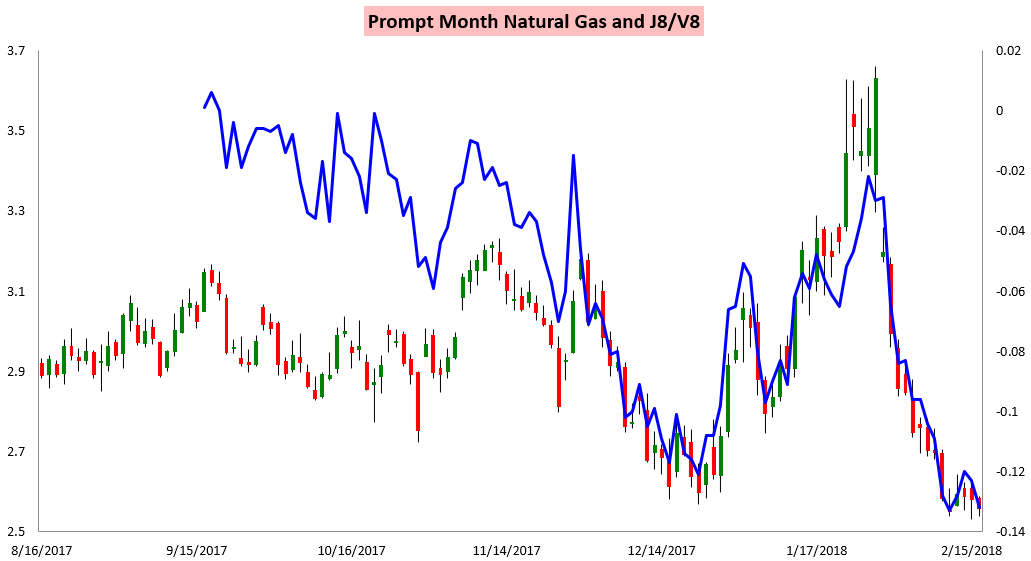

The late-week warm trends were better reflected in J/V, which declined back towards lows as estimates for how much gas we walk out of withdrawal season with continued to increase.

Today’s trading fell right within our expectations, with our Afternoon Update for clients yesterday emphasizing that we saw firm support from $2.52-$2.55 but limited upside today.

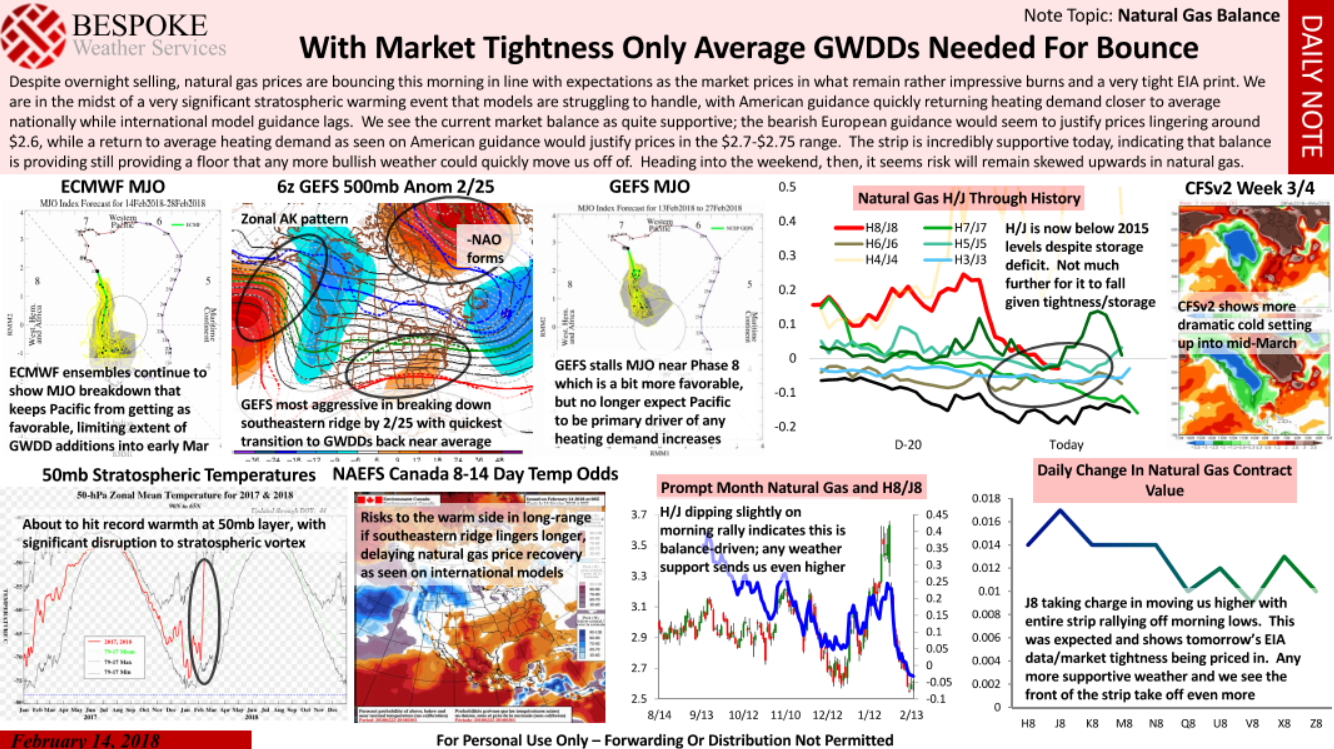

Back on Wednesday, we commented in our Note of the Day to subscribers that the strip was supportive and market tightness would continue to add a floor for prices we could move off of with colder weather. That colder weather did not arrive, but the floor held.

Our Note of the Day yesterday further confirmed this floor, as we warned that it should hold even with the warming trends we were seeing.

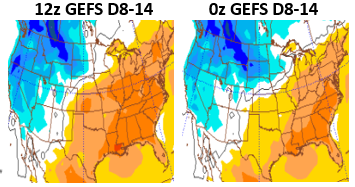

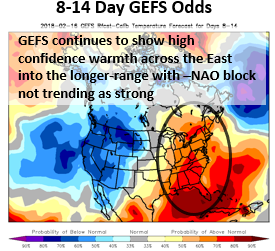

Those forecasts did continue to warm too, with afternoon GEFS guidance today showing an even stronger ridge across the East in the 8-14 Daytime frame (images courtesy of the Penn State E-Wall).

We highlighted this to clients in today’s Note of the Day as well.

Despite this lackluster price action headed into the holiday weekend, there are signs that more volatility should return next week, with the first being that we will have a few days of weather model changes to price in.

Leave A Comment