It was the bearst of times. It was the worst of times.

Heh. OK. Now that we got that out of the way………

Anyway, my portfolio is presently 70% in shorts (70 of them, in fact) and 30% in cash. I am thus “cautiously pessimistic” about the market, in spite of Yellen and Kuroda coming up this week (the AAPL risk has passed, as the stock seems to be simply leaking a little bit lower and is most definitely not inspiring folks about the wonderful earnings season).

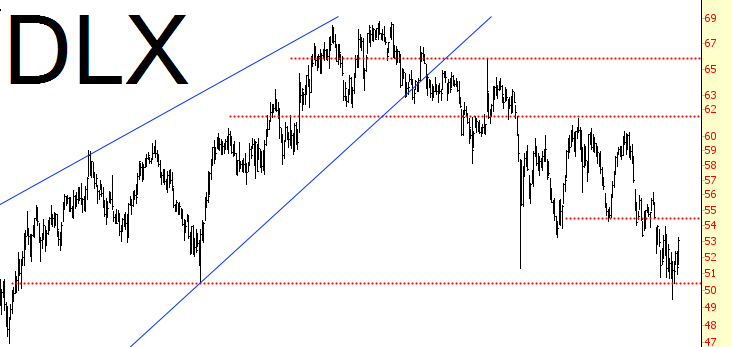

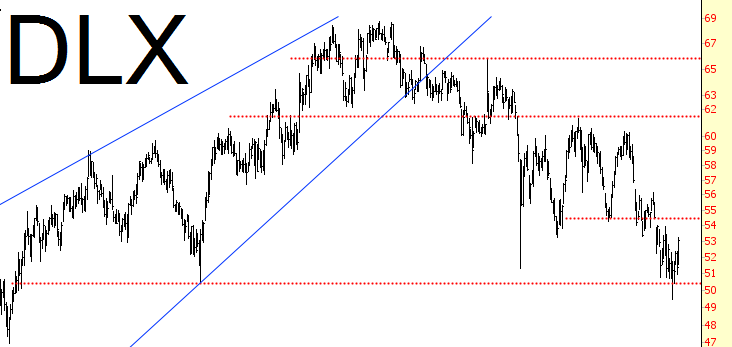

My shorts are, by definition charts that I think have topped out and are prone to fall. In spite of the heavy selling (which ended, for now, last Wednesday), there are still many stocks that don’t look oversold. If anything, they look primed for a glorious fall, such as Deluxe, shown here:

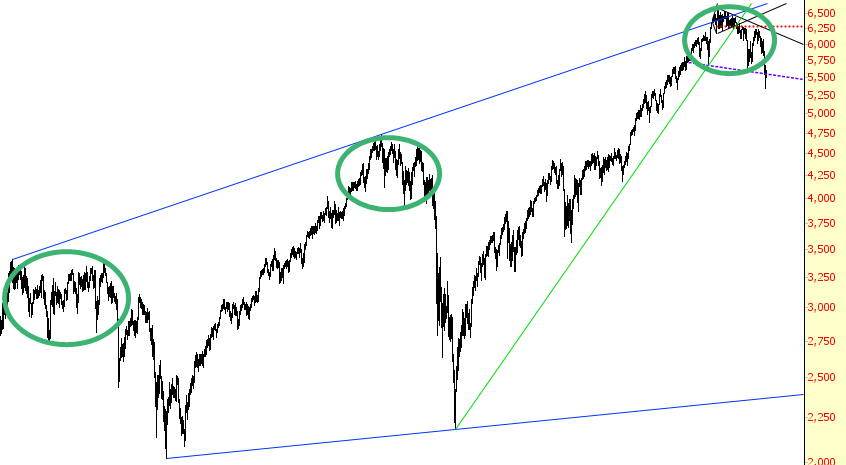

On the other hand, I’m following a large swath of stocks – about 125 right now – that would make glorious shorts if only they were, oh, about 20-30% higher! Now that’s obvious a horrible risk/reward ratio at their present prices, so I’m not touching them with a ten foot pole. Here’s an example:

So this is tricky, because unlike late December, when ALL stocks were fantastic shorts, now we’ve got this terrible split. On the one hand, it gives a lot of stocks plenty of room to the upside without violating any of the major downtrend, but on the other, it also means all those wonderful shorts I’ve got right now are vulnerable to getting swept up in just such a rally.

I can only let price action dictate which stocks survive the trip and which do not. There’s one thing I do know, however, and that is this: even if we do get a rally (which would be essential to get these 125 stocks up to decently shortable levels), the long-term picture is blatantly bearish. I guess I’m just too much of a brat to want to wait too long for the jets to start kicking in once more to the downside.

Leave A Comment