In the press conference following today’s wimpy rate hike decision by the Fed, chair Janet Yellen responded to a reporter’s question about the possibility of a hike in October.

Yellen stated that October was still on the table because every meeting is a “live meeting“, and if the Fed hiked it would conduct an impromptu press meeting following the decision. Her answer reflects the fact there is no scheduled press conference following the October meeting.

What a joke.

The market effectively laughed in her face. Not only does the market not see a hike in October, it does not see one in December either, in spite of the fact that Yellen stated the majority of the FOMC participants still see a hike this year.

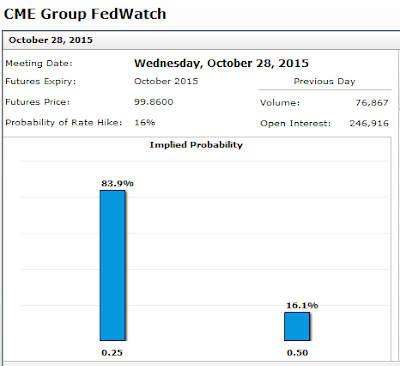

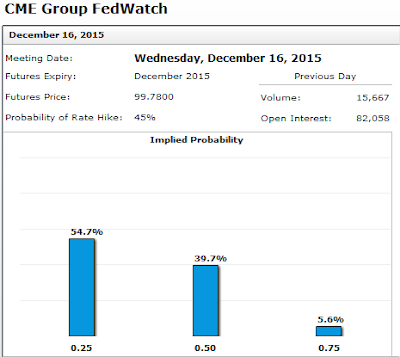

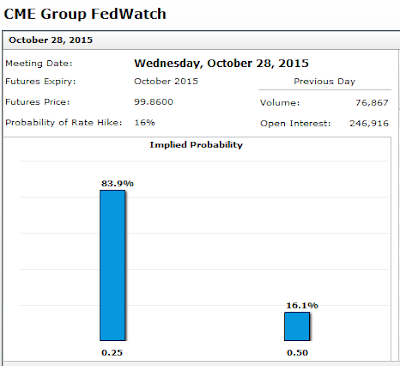

The CME Fedwatch sees things a bit differently.

16.1% Chance of Hike in October

45.3% Chance of Hike in December

Rate Hike Odds Discussion

Bear in mind the CME odds represent quarter point hikes even though the Fed Fund Futures very slowly price in hikes of an eighth of a point.

Fed Fund Future Calculations

To arrive at an implied “30 day” average interest rate, subtract the “last” column in the table below from 100.

Fed Fund Futures September 2015-March 2016

Looking at futures alone, not options, one has to go all the way out to January 2016 before the implied Fed Funds rate edges above 0.25%.

Fed Fund Futures July 2016-January 2017

I suppose the next hike could be to 0.25-0.50% but then one does not see 0.50% happening until a July-August 2016 timeframe!

The Fed Fund futures do not see rates getting as high as 0.75% until January 2017.

I highlighted +0.125 in October 2016. That column reflects the implied change from yesterday to today. +0.125 just happens to represent precisely 1/8 of a point hike.

Today the market took away an eighth of a point hike, over one year into the future, with the implied rate 13 months from now a mere 0.62%, about 5/8ths of a percent.

Baby Steps

These implied baby-step moves are why I stated that rate hikes, if they come would be in 1/8 point increments. I had the odds of 1/8 point hike today at roughly 50-50.

The Fed could move in quarter point announcements, yet let the implied rates creep up effectively moving in 1/8 point steps, but that would mean a long time between numerous meetings before anything changes at all.

Point is Moot

The above point about eighth of a point hikes vs. quarter points hikes was likely made moot today.

By December, the economic data is likely to be weakening so much, that the Fed may not hike until the next recession is over.

Mike “Mish” Shedlock

Leave A Comment