Photo Credit: Intel Free Press

VMware, Inc. (VMW) Information Technology – Software | Reports January 26, After Market Closes

Key Takeaways

Over the past 5 years, clouding computing has experienced robust growth as consumers shift away from license based software to cloud based services. At the moment cloud computing consists of three major components; platform as a service (PaaS), software as a service (SaaS) and infrastructure as a service (IaaS). One of the leaders in SaaS, VMware is scheduled to report Q4 2015 earnings January 26th, after the markets close. VMware specializes in virtualization solutions to solve various IT problems. VMware is primarily known for its flagship product, the vSphere hypervisor, which has the leading market share in x86 server virtualization.

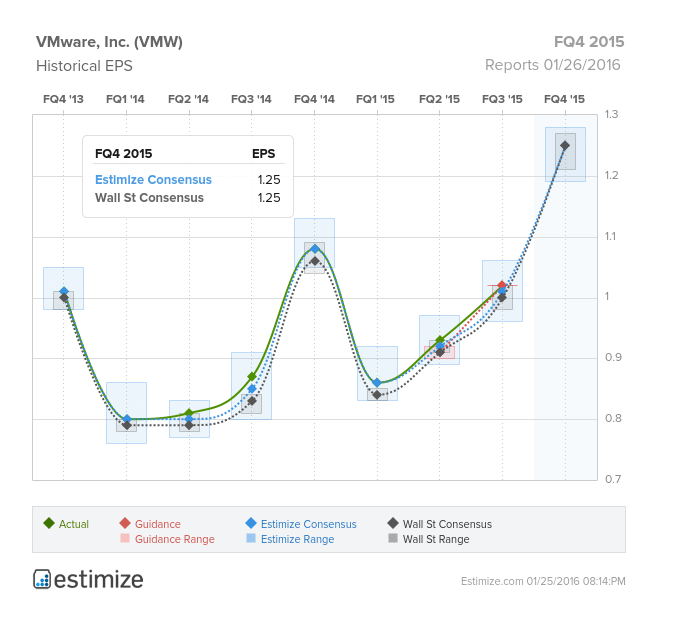

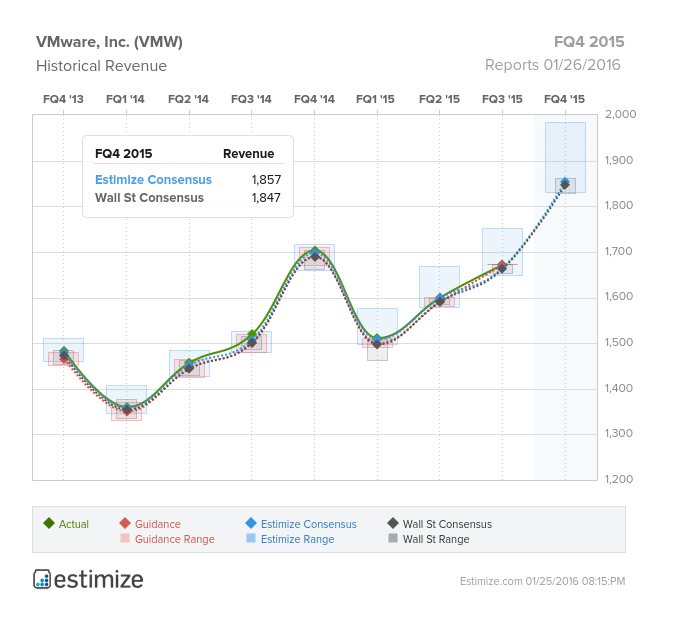

For this quarter, the Estimize community is expecting EPS of $1.25 and revenue of $1.857 billion, right in line with Wall Street’s estimates. Compared to Q4 2014, this represents projected YoY growth of EPS and revenue of 16% and 9%, respectively. The company’s robust R&D, presence in IT virtualization and strong partner networks helps differentiate VMware in a crowded market. Despite limited downside, VMware shares have suffered as of late due to the rumored acquisition of its parent company, EMC.

In the largest takeover in technology, Dell agreed to purchase EMC in late 2015. EMC has insisted the crown jewel of its portfolio, VMware, would not be apart of the deal. However, speculation has caused the VMware stock to plunge with share prices falling a resounding 38% in the past year. Meanwhile, VMware’s joint venture with EMC’s Virtustream fell through as VMware struggles to attract customers to its vCloud Air. Furthermore, stiffer competition from tech giants, Microsoft, Citrix, and Amazon to name a few, have initiated a pricing war within the industry. On the bright side, the outlook of the SaaS remains positive and with continual new product rollouts, VMware has the pieces in place to stay successful. VMware also continues to form strong partnerships with leading companies and in 2015, the company initiated strategic relationships with Samsung and Google. As a result, the company still has a long runway for growth and should continue to post sales growth.

Leave A Comment