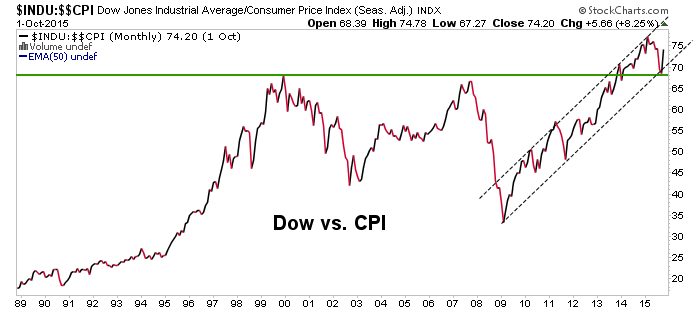

In an NFTRH edition a few weeks ago we showed the decline in the Dow vs. the CPI right to a support area.That was the result of the market damage that was incurred in August.We also noted that the cut off date for a chart was September 1, as its data are delayed.

With the market bouncing at the time the chart was shown, we projected this ‘confidence gauge’ would bounce as well.Sure enough…

The cut off for this data is October 1, so it is once again out dated.But you get the picture.There are so many different ways to view implied confidence in the Fed, but I think this is an important one because were the Dow to stop keeping up with consumer prices, the only trick the Fed’s got going – asset market appreciation and wealth effect – would be kaput.

Dow (and S&P, NDX, etc.) have been gold on this cycle and that is what dogmatic gold bugs refuse to either see or admit.The inflation went into equities and that is just the way it is.See this post about Copper’s ultimate downside target at Biiwii for an idea of when maybe things might change to a more traditional inflation.

To this point however, US equities have benefited from a global deflation inspired Goldilocks environment.

Leave A Comment